What is tariff advisory committee?

Have you ever wondered how a body of government defines a tariff rate for imported products? It turned out to be the work of a governing body known as the Tariff Advisory Committee (TAC). This article will give an explanation of what is tariff advisory committee is and its roles for a government in a country. How does the tariff advisory committee work, and how big is its authority? Here are some details on their functions and work system.

Who can be a member of the tariff advisory committee?

What is tariff advisory committee? They are basically people with specialized knowledge on the economy, trade, and international law. Normally, this group consists of economists, legal advisors, trade specialists, and industry representatives. People outside of direct trade and legal sectors, such as experts in politics and languages, can also be involved, as they can provide valuable and broader insights into trade agreements and regulations. It could be geopolitical and security risks, cultural contexts, and many more.

The Tariff Advisory Committee was established by the government or regulatory authorities to provide recommendations, advice, and insights on trade policies in general. This is necessary in order to maintain economic stability, both to accommodate national interests and protect consumers’ rights.

Key tasks of the tariff advisory committee

To get to know what is tariff advisory committee, we can divide its main roles into 4 categories below.

1. Analyze market trends

In order to provide pristine recommendations and advice, the tariff advisory committee needs to do diligent work in market trends and data analysis. Each day, there will be staff who report on trade flows, market price dynamics, supply chain situations, business performance, demand and sales volumes, disruptions, and many more.

2. Review tariff proposal

The Tariff Advisory Committee works by studying tariff rates and changes proposed by related parties. These are crucial roles as their consultancy will affect domestic industries, consumers’ rights, and transnational trade continuity.

3. Prepare recommendations

As a group of experts, the tariff advisory committee is also expected to provide consultancy. This includes recommendations of a proportional tariff rate, which will be aimed at protecting local industries while also maintaining competitiveness and global trade fairness.

4. Maintain communication with stakeholders

Despite working mainly for the regulatory authorities, it is also essential for what is tariff advisory committee to consult with other stakeholders, such as representatives of industry/business units, trade associations, and experts, to gather insights and better understand local economic dynamics.

5. Formulate trade policies

After gathering inputs and insights, what is tariff advisory committee’s role is expected to help the government plan and formulate its customs as well as trade policies.

6. Cultivate accountability and integrity

The Tariff Advisory Committee has an obligation to foster transparency, accountability, and integrity in its institution. This will help a nation balance between its duty to provide better outcomes for local industries, generate revenue, as well as maintain relations with other global traders. Without the three essential principles, what is tariff advisory committee established for?

Why is the tariff advisory committee important?

After understanding what is tariff advisory committee’s roles, you might wonder why they are so important. Here are four key points to know its roles that you can use as considerations.

1. Their consultancy will impact domestic industries

Tariffs and taxes on imported products have an impact on domestic industries. A rise in tariff rates may help the government protect local businesses or producers, yet it could also impact the competitiveness level. Thus, a balanced calculation needs to be done and it requires efforts on research, negotiation, and analysis, which what is tariff advisory committee is expected to provide.

2. They can influence prices

The Tariff Advisory Committee’s work will also either directly or indirectly influence the prices of imported goods. It is important to keep in consideration the nature of the goods. Once they are considered essential or staple goods, it will greatly affect consumers’ routine expenses. Thus, tariff advisory committees are required to consider many aspects of the tariff before determining the final resolutions.

3. Help the government generate revenue from trade

If you already understand what is tariff advisory committee, you will not be surprised that one of their main functions is to generate income for the government. This is also a common trade advantage, as a country needs to gather revenue in order to operate and provide services for its people.

4. They play key roles in maintaining international relations

Tariffs are closely related to national interests. Along with gross national products, tariffs are often used as bargaining power in transnational politics and the economy. It will influence the diplomatic effort and lobbying process. Furthermore, this will also shape international landscapes such as economic alliances, trade agreements, and many more. Therefore, it should be clear that the tariff advisory committee will have to comply with the rules formulated by supranational organizations such as the World Trade Organization or other regional economic alliances.

How does each country regulate the tariff advisory committee?

Each country has its own specific way of regulating its trade through the tariff advisory committee. They tend to have a different set of names and authorization for this governing body, depending on their governmental systems and interests.

Federal countries tend to use a democratic and decentralized system with multiple advisory committees in each state. Meanwhile, in countries with a unitary system, the commission could be centralized in one institution directly under the state (state-controlled).

Each system has its own strengths and weaknesses based on its character. A decentralized system allows each state/province to voice its inputs and interests for consideration. Therefore, it could benefit local industries and guarantee their interests. Yet, it will take more time and effort to collect the voices before formulated into recommendations.

In contrast, the unitary system will allow the determining process to be faster and more efficient. However, there is no guarantee that all business units get what they need. This will be dangerous and unfair for smaller industries with no direct representatives. The voice or representative from small businesses should be included in what is tariff advisory committee’s task is for?

How do we know the tariff rate in each country?

Now, how do we know the fixed tariff rate in each country? It is normally available online in English through the tariff advisory committee websites. However, for your consideration, it is necessary to note that some countries do not provide an English version and require you to translate it. Thus, a professional translator can also be considered as a tariff advisory committee member or staff.

If you are interested in trading with China, their tariff advisory committee website is available through the Ministry of Commerce (MOFCOM), USA, through the U.S. International Trade Commission (USITC). For European Union members, you can try to search on their Taxation and Customs Union website. Moreover, if you need broader options, you can access databases provided by the World Bank and the World Trade Organization (WTO). This is a meticulous task as each country has specific arrangements and requirements for particular products or goods.

How to find tariff rates in each country using HS Code Match

After knowing what is tariff advisory committee, we should know about the tariff rates and how to find tariff rates. However, this process is quite challenging due to the constantly changing nature, and it requires patience in order to find the right tariff rates. Other than finding the tariff rates of each country through the government website, you can also use HS Code Match from Jureem. This website also provides accurate, up-to-date news and information on regulations based on government publications. If you are wondering how to find the tariff rates using the HS Code Match. These are the steps to use HS Code Match to find the right and best tariff rates.

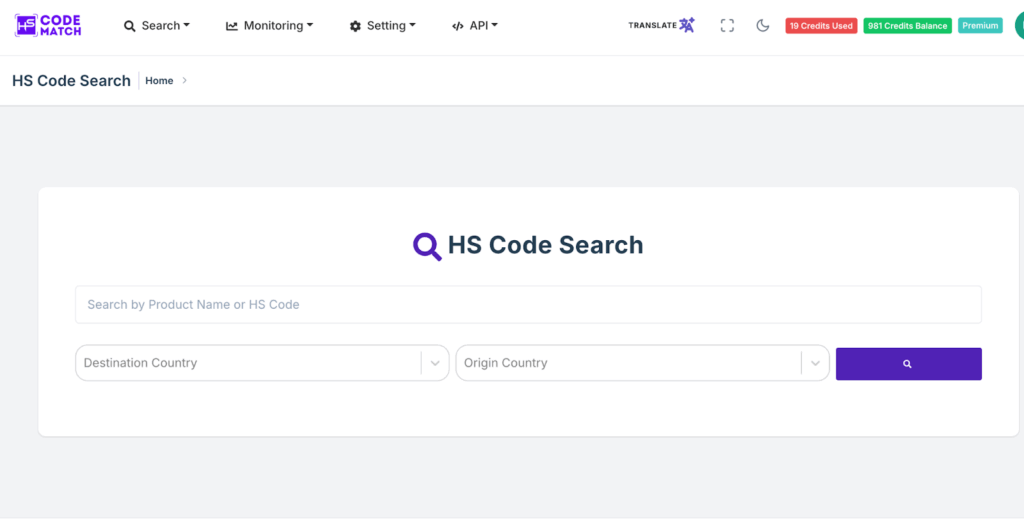

- Step 1: Open the HS Code Match by accessing hscodematch.com through your browser. Then, choose Go To App in the right corner to access the HS Code Search tool.

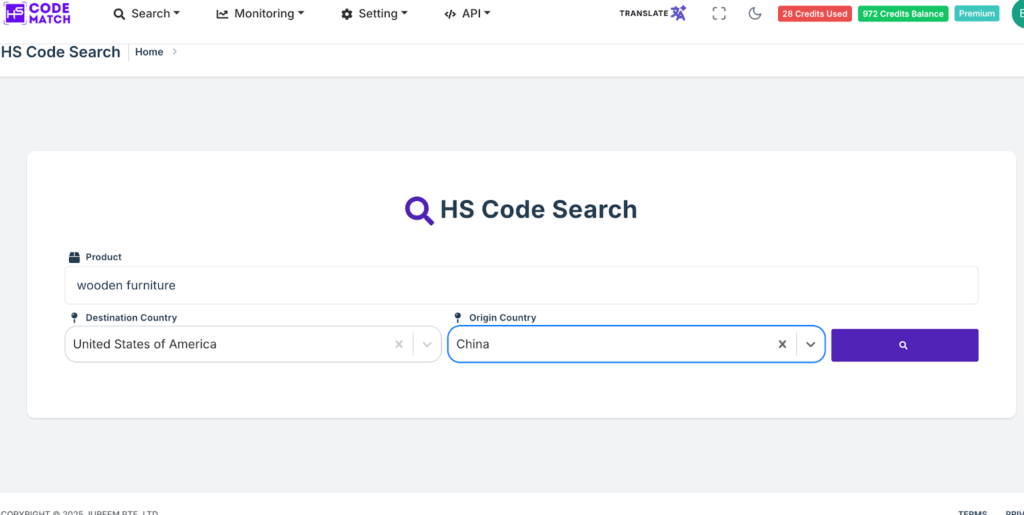

- Step 2: Set the product name, country of origin, and the destination country that you are looking for. Similar to a common search engine, once everything is set, please click the search button. For example, we can choose the wooden furniture from China to be shipped to the United States.

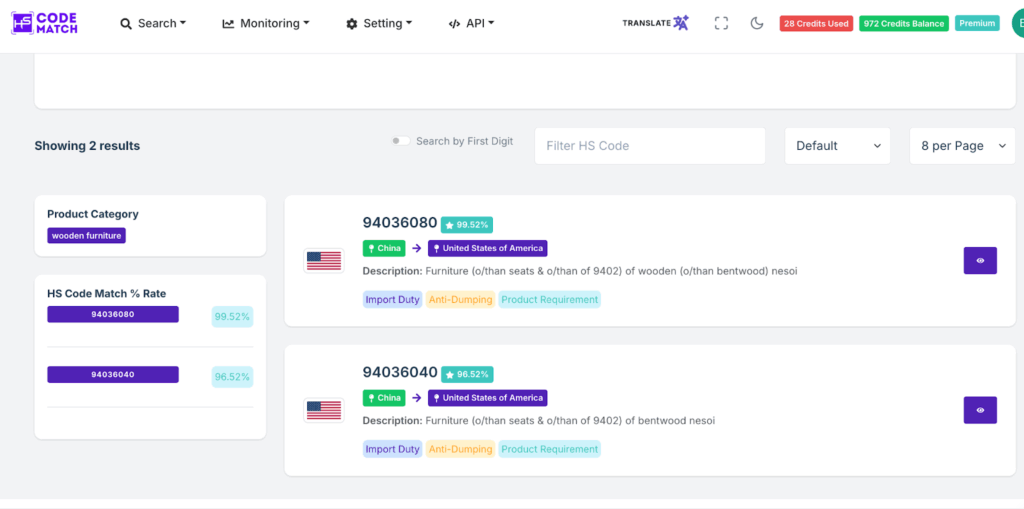

- Step 3: The HS Code Search will automatically give the best preference for the HS code and the tariff rates. The example shows two types of HS codes for wooden furniture to be sent to the United States. You can choose one of the HS codes based on your preference and the details of the product.

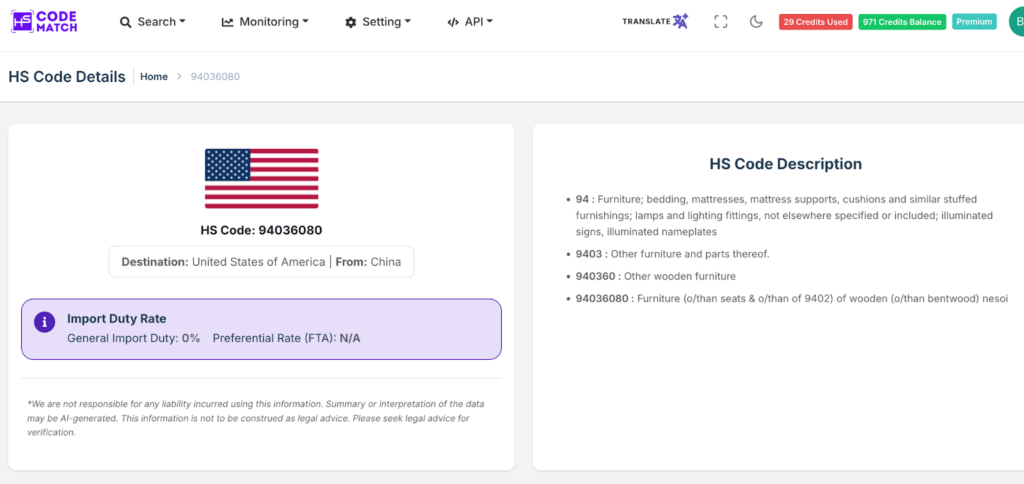

- Step 4: After clicking on one of the HS codes and the tariff rates list in HS Code Match. You can see the details of the regulation from the United States and the HS code description.

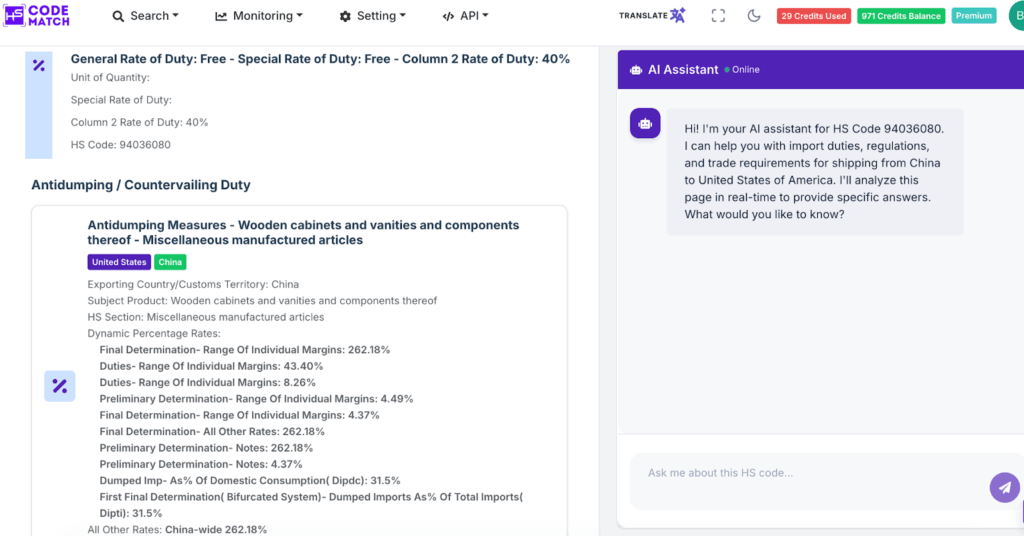

- Step 5: Below that, you can see the details of the latest regulation from the United States. There is an anti-dumping measure for wooden furniture from China. To know more about a specific part of the trade regulation, you can use the AI Assistant. You can ask anything or ask for a summary of the regulation.

Using HS Code Match enables you to find the HS code or tariff rates easily. If you want to know more about the customs or other regulations for the export and import process, you can use the HS Code Match advanced tool, called the Customs Insights Search Tool. This tool provides information from the HS code, Partner Government Agencies (PGAs), and the procedure for exporting products to the destination country.

What other critical aspects of the tariff advisory committee?

After understanding what is tariff advisory committee is comprehensively from the explanation above, we know that this body is important for giving recommendations to the government before formulating the tariff rates. There are several critical aspects you need to know when working with tariff import.

1. Tariffs can be used as a political weapon

It is widely known that tariffs are used by certain political actors to gain profit and put pressure on others. Thus, the involvement of political analysts in what is tariff advisory committee is considered necessary.

2. Balanced representation is encouraged

It is commonly known that what is tariff advisory committee generally consists of experts and industrial representatives. Yet, it will be beneficial to make sure that each of the industrial elements is involved. For example, besides engaging with the higher-ranking executives, tariff advisors should also come from regular workers who can be represented by their unions. Consumers are also a great source of feedback as they might have first-hand experiences with the products on grassroots levels.

3. The Tariff Advisory Committee does not make policies

It is important to note that what is tariff advisory committees’ tasks are not to a decision makers. They are more or less a government helper. Moreover, their objective is to shape the policy by arranging a balanced outlook for the government. Their role is limited to providing recommendations based on market analysis and feedback from industries. Governments might refuse to comply with their input.

4. There is a Tariff Advisory Committee at the regional level

As we live in the globalized world (interdependence era), it is possible to find a tariff advisory committee that works at the regional level. The European Union and ASEAN have this type of institution, which will affect the way its members behave in global trade.

Conclusion

The Tariff Advisory Committee (TAC) has a crucial role in giving advice and recommendations to the government. They consist of experts from many backgrounds of study. Their recommendations and advice are also based on scientific research, market trends, and data analysis based on the current situation. The reports from TAC must be held accountable for helping the government to formulate tariffs and understand the impact of the tariff rates.

However, not all countries in the world have a Tariff Advisory Committee due to the different government structures in each country. Some countries give the high-level government bodies to formulate trade policies through their ministers or special authorities. Countries without a Tariff Advisory Committee usually rely on the Ministry of Finance or the Customs Authority in order to determine the tariff rates.

Frequently Asked Questions (FAQ)

1. What is tariff advisory committee?

The Tariff Advisory Committee is basically a governing body that was given authority to determine tariff rates and taxes on imported products through recommendations, advice, and insights to the government of a country. However, the tariff advisory committee did not have the authority or decisive action to implement the tariff rates.

2. Who are the members of the tariff advisory committee?

They are generally a group of experts in economics, law, trade, and transnational politics. The representatives of industries are also required to be considered as active members. Several language experts, such as translators and interpreters, can be involved to help smoothen the negotiation and documentation process.

3. What is Trade Advisory Committee’s main tasks?

Their main task is maintaining the economic balance, which consists of protecting local industries, generating revenue for the government, maintaining proper consumer prices, and, in the end, fostering relationships with global traders.

4. Why is Trade Advisory Committee prominent?

The Tariff Advisory Committee exists to help the government run its functions to serve the people and accommodate the national interests. They are also designed to be responsive and farsighted towards the fluctuation of world trade dynamics: disruptions, disorder, and changes.

5. Do all countries have a tariff advisory committee?

No, instead of creating an independent or separate formal committee, some governments decide to manage their tariff rate through other greater governing bodies, such as ministries. However, some countries still have TAC. For example, the United States has the United States Trade Representative (USTR), who administers 26 committees from many sectors to conduct trade negotiations and formulate the trade policy.

6. How can I find tariff rates of each country?

It is commonly available on each tariff advisory committee website of each country. You can also check database sites provided by international government organizations such as the World Bank and the World Trade Organization.

7. Are the public involved in tariff advisory processes?

Unfortunately, the public is not generally involved in tariff advisory processes. They are being represented by experts or representatives of industries. Yet, this does not guarantee that those members are responsive and sensitive enough to public interests. However, in several countries, tariff advisory processes can be done through public hearings, which allow common people to participate in the process.

8. Does the tariff advisory committee decide the tariff and tax rate of imported products?

No, they give advice and recommendations based on a thorough and meticulous study to the government. Thus, the final decision is in the hands of the government. They will decide it based on those recommendations and analyses provided.

9. Should digital products be regulated by the tariff advisory committee?

It is an emerging issue that governments are starting to look into. Digital products such as e-books, music, software, online games, cloud-based services, and blockchain-based goods are today’s lucrative industries. However, there are debates over valuation and jurisdiction, so that it remains a relatively complex situation, and the policy formulation is still ongoing.

10. What is tariff advisory committee’s recommendations to the government?

The tariff advisory committee provides recommendations based on the market trend and the data analysis. This is one of what is tariff advisory committee’s main tasks for giving advice to the government to avoid mistakes and predict the impacts due to the implementation of tariff rates.

Oct 24,2025

Oct 24,2025  By admin

By admin