What is HS Tariff Code eBay

The latest statistics from Q1 2025 indicate that there are approximately 2.3 billion products marketed on eBay, with 134 million active global buyers and 17.6 to 20 million active sellers. eBay has continued to grow since its inception in 1995 and remains a major player in international trade. eBay is a place where buyers and sellers meet across national borders. However, challenges in buying and selling goods globally always relate to shipping costs, regulations, and, of course, tariffs. In this article, we will learn what eBay’s HS Tariff Code is, why it is important, how to find it, and some important tips.

What is HS Tariff Code

HS stands for Harmonized System. It is a system used to classify goods sold or purchased globally—international goods. This system is managed by the World Customs Organization (WCO). Therefore, in short, the HS Tariff Code is an international goods classification code. This code is frequently requested by customs authorities in various countries to identify the types of goods entering or leaving, in the context of international trade.

The HS Tariff Code consists of six digits, with the first two digits describing the chapter or broad category of the commodity. Then, combined with the following two digits, it becomes a four-digit code, describing the heading or main type of goods within the broad category. The last two digits, called subheading, provide a more detailed description of the main type of goods.

For example is the code 8517.12 is described as follows:

- 85 is the chapter that describes the broad categories of electrical machinery and electronic equipment, such as computers, radios, televisions, telephones, and digital communications equipment.

- 8517(heading) is the code for electronic equipment that transmits voice, image, or data over a wired or wireless network. This could be a telephone, router, modem, or network communications device.

- 8517.12 is the subheading containing the code for cellular phones or smartphones.

What is HS Tariff Code eBay

As an official international trading platform with over 30 years of experience, eBay supports each country’s policies regarding tariffs on incoming and outgoing goods by requiring an HS Tariff Code for every item sold on its platform.

On eBay, before an item appears on a product page, sellers are required to include the country of manufacture and the HS Tariff Code. This demonstrates commitment of eBay to aligning its services with each country’s customs regulations. eBay actively monitors changes in import and export policies from each country, which, of course, impacts sellers and buyers on its platform.

So, what is HS Tariff Code eBay? It’s an international goods classification code that forms part of the information on eBay product pages–mandatory for products shipped outside the country or internationally. It’s combined with the item name, photo, price, description, and category. It consists of the first six digits of the relevant code, without periods or separators.

Why are the HS Tariff Code Important on eBay

Here are some reasons why HS Tariff Codes are important on eBay.

1. From eBay’s perspective: Maintaining Credibility & User Trust

eBay’s efforts to maintain the credibility of its international trading platform include requiring sellers on its platform to include the HS Tariff Code, especially for items with high sales value in various countries.

This effort demonstrates eBay’s compliance with international trade regulations, specifically meeting the official requirements of the WCO for goods entering and leaving a country. If eBay neglects to require its international sellers to include the HS Tariff Code, several dire consequences could occur, such as:

- Logistics partners like DHL or FedEx are unable to process shipping labels,

- EBay’s relationships with customs authorities or international couriers could be damaged,

- The potential loss of international shipping permits and even administrative fines could be inevitable.

- Without an HS Tariff Code, items sold internationally on eBay are at high risk of shipment detention or return. This situation makes eBay perceived as unprofessional by both users and logistics partners. As a result, user trust begins to decline or even disappear.

- An automated shipping system crash occurred, resulting in the system being unable to calculate import taxes, determine export permits, or electronically transmit trade data to customs. This occurred because eBay’s integrated international labels, such as the Global Shipping Program and eBay International Delivery, were unable to process shipments without an HS Tariff Code.

2. From the Seller’s Perspective: Estimating Import Costs & Smooth Cross-Border Transactions

By entering the HS Tariff Code, sellers can obtain data from international labels integrated with eBay to automatically estimate import costs, specifically taxes and international import tariffs.

The HS Tariff Code helps sellers determine the selling price of international goods more accurately because it includes estimated import costs.In fact, certain eBay systems, such as eBay International Delivery, pre-pay all costs for international trade, both import fees and shipping, through Delivery Duty Paid, so buyers simply receive the goods without worrying about customs or shipping costs.

Sellers’ awareness of the importance of entering the HS Tariff Code on eBay can also improve their business performance globally, enabling smooth cross-border transactions. If, for any reason, a seller accidentally forgets to include the HS Tariff Code on their merchandise, the international buying and selling process through eBay cannot proceed. Yes, eBay’s system cannot process any international trade without an HS Tariff Code – for a full explanation, see point 1.

In fact, even if a seller has successfully entered the HS Tariff Code, but there’s even a single digit error, the immediate consequences are:

- Surging import costs (tariffs and taxes), because an incorrect code is the same as an incorrect tariff.

- Customs is holding goods because the type of goods and code don’t match.

- Fines, return fees, and clarification fees apply.

- Credibility decreases as buyers lose trust due to disappointment with late or even unsuccessful deliveries.

3. From the Buyer’s Perspective: Indirect Impact

What is an eBay HS Tariff Code for buyers? For international buyers using the eBay platform, the HS Tariff Code is also important, although not directly. Why? When sellers on the eBay platform correctly list the HS Tariff Code on their items,

- Buyers don’t need to worry about their orders being canceled or held by customs, as they are guaranteed to arrive on time.

- Buyers don’t need to pay additional taxes or import tariffs.

- Buyer confidence increases, without worrying about goods being destroyed by Customs for being deemed illegal – there’s no HS Tariff Code or the HS Tariff Code doesn’t match the type of goods purchased or shipped.

How to Find HS Tariff Code on eBay

eBay’s global reach and extensive experience, established in 1995, has accommodated a wide variety of products from diverse sellers worldwide. This fact certainly confirms the widely circulated statement that not all HS Tariff Codes are automatically available on eBay. In short, eBay does not provide an HS Tariff Code catalog for every type of product currently available and marketed on it.

This leaves sellers on the eBay platform solely responsible for finding, determining, and correctly setting the HS Tariff Code that will appear on eBay product pages. To learn how to find, determine, and set the HS Tariff Code for products to be sold on eBay, follow these steps using HS Code Match.

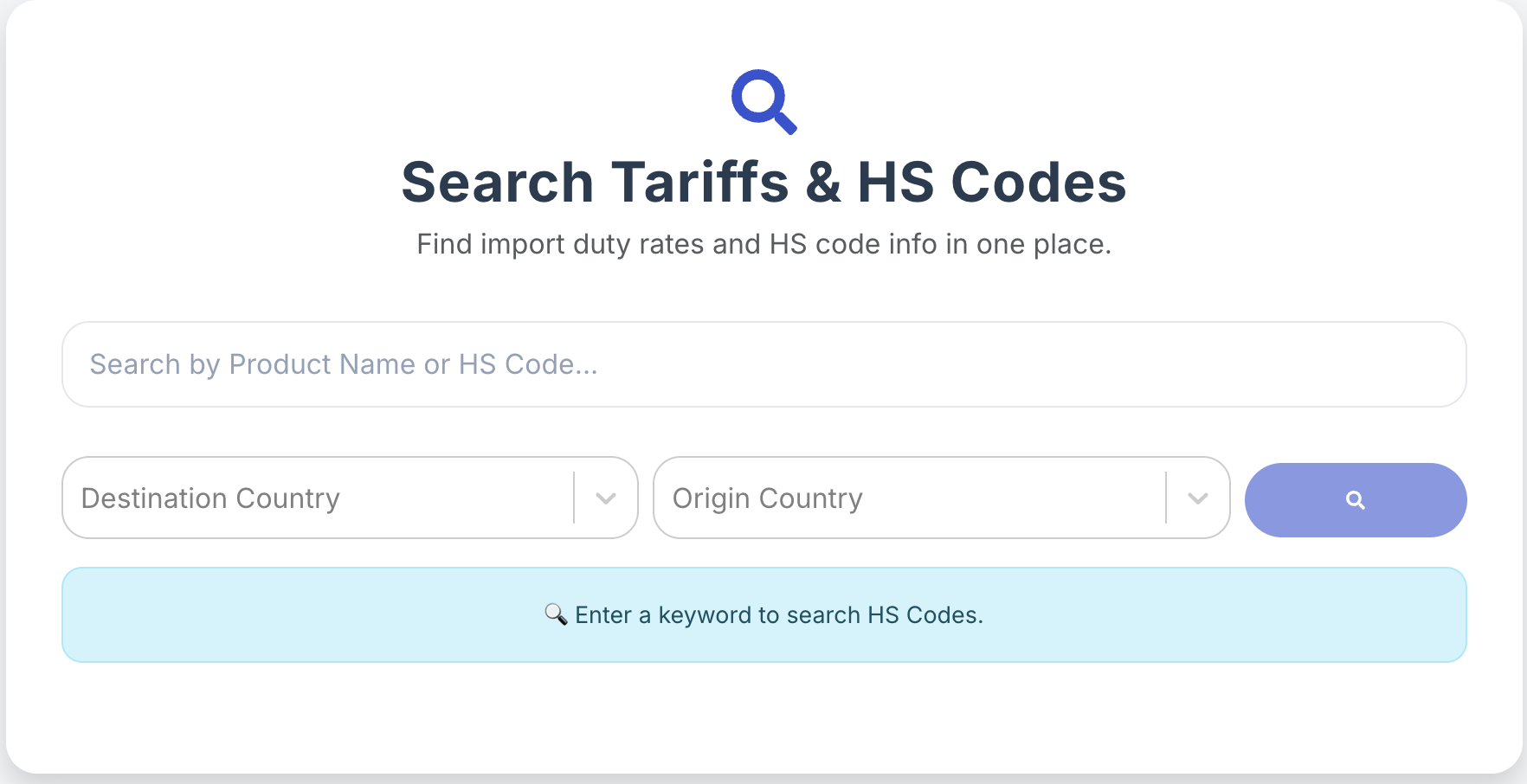

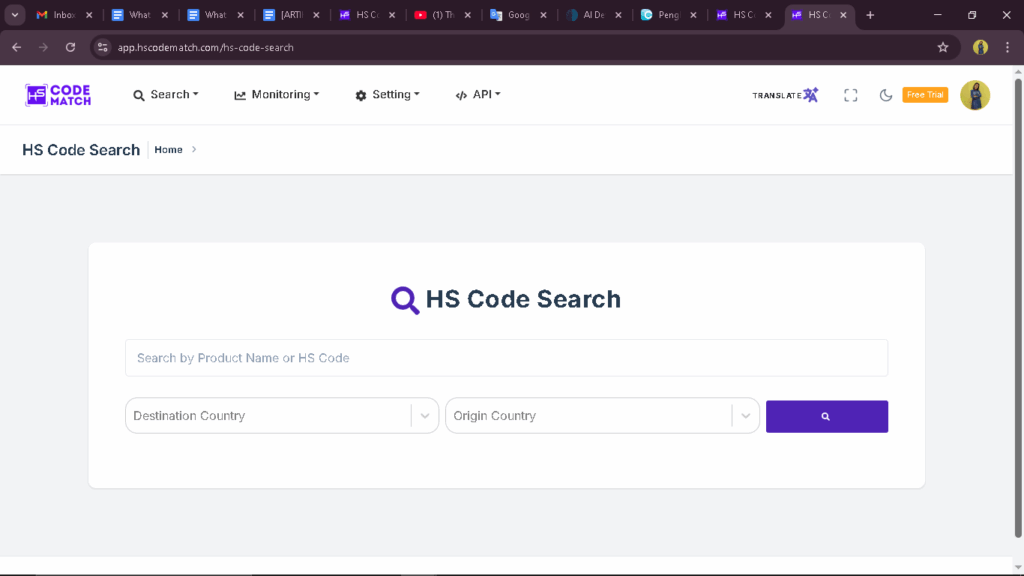

- First step: Open hscodematch.com to find the best HS Tariff Code based on the product type.

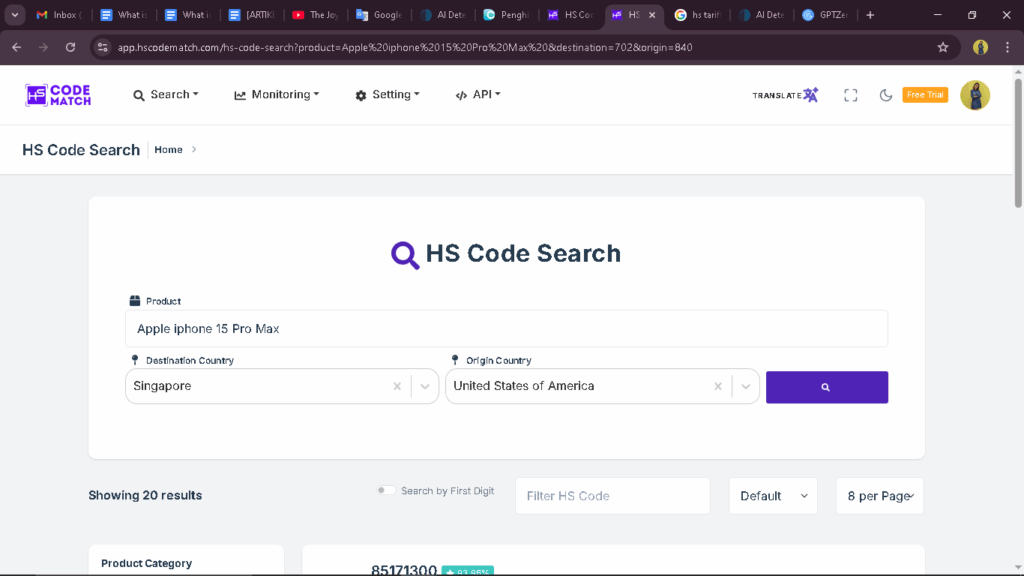

Second step: Describe the product in detail to accurately classify the HS Tariff Code. These details include: What is the product name? What is its function? What is it made of? What does it look like? And is the product new or used? Describe it in as specific terms as possible. For example, “Apple iPhone 15 Pro Max.”

Then, enter the destination country and the country of origin for the product → click the search symbol.

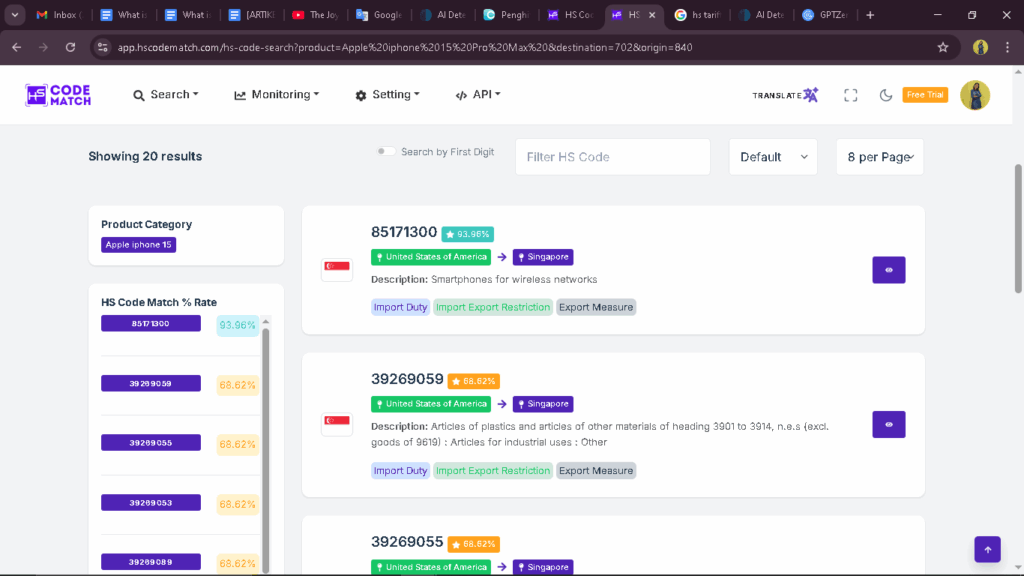

- Third step: Several results will appear. Select the HS Tariff Code with the highest match rate. Keep in mind that the international HS Tariff Code standard is only 6 digits. Therefore, use the first 6 digits without dots to enter on the eBay platform. The remaining two digits are simply the national code for the country of origin, in this case, Hong Kong.

- Fourth step: Ensure the code matches the destination country, keeping in mind that each country is allowed by the WCO to add two to four digits as a special national code.

- Fifth step: The final step is to double-check and even update the product description details if necessary. For example, if a previously used or used item is converted into a part or component of a product, the item description details—its classification—can be changed accordingly.

However, eBay still facilitates its sellers by providing suggestions or examples of HS Tariff Codes. Yes, although the level of compatibility with the product type is not automatically 100%.

The Procedure for Using HS Tariff Code on eBay

After successfully finding, determining, and assigning the HS Tariff Code, sellers need to consider the next steps for listing the HS Tariff Code on the product page on eBay. As an illustration, a seller from Hong Kong wants to sell an “Apple iPhone 15 Pro Max” on eBay to a buyer in Singapore:

- First, fill out the product page on eBay with detailed product information, such as the name, photo, price, category, and the HS Tariff Code previously found using hscodematch.com: 851713 – use the first 6 digits without dots.

- Then, the buyer will click the checkout button.

- The eBay system will then automatically estimate the import costs, including tariffs and import taxes, to Singapore.

It’s important to note that at this stage, your logistics partner, acting as the shipping service, will also provide a shipping cost estimate. - The HS Tariff Code will be listed on the international shipping label, under “Customs Information.”

- International shipping via eBay takes approximately 20-45 days. When the goods arrive at the destination country, namely Singapore, with the correct HS Tariff Code, customs officers will immediately recognize the type of goods and can proceed to the process of inspection and approval of the goods by customs or commonly called clearance.

Important Tips for Correct HS Tariff Code on eBay

To avoid fatal errors (fines) for both sellers and buyers on the eBay platform, the HS Tariff Code must be accurate. Here are some tips for ensuring the HS Tariff Code listed on eBay is accurate:

- The first and foremost tip is to avoid guesswork or entering random numbers to determine the HS Tariff Code. Choose a trusted and official external site like the HS Code Match Website to find, determine, and assign the correct HS Tariff Code.

- The next tip concerns detail. How detailed is the product description on the official external site? The more detailed, the less likely it is to be wrong.

- Ensuring compliance with the coding rules applicable in the destination country for international trade—keeping in mind that some countries add two to four digits to the HS Tariff Code—is another important tip to consider in determining the correct HS Tariff Code for your international product.

- Furthermore, referring to international customs or the World Customs Organization (WCO) is also an important tip to note in obtaining the correct HS Tariff Code. Keep in mind that every five years, the WCO updates its official list of international goods classifications, which forms the basis for various HS Tariff Codes worldwide.

- The final tip in this article about What is HS Tariff Code eBay is related to the involvement of other parties, such as international trade consultants, if we are faced with a difficult situation in the process of determining the HS Tariff Code correctly.

Conclusion

This article on “What is HS Tariff Code eBay” goes beyond simply explaining the general meaning of HS Tariff Codes in international trade. It also highlights the importance of HS Tariff Codes for eBay, its sellers, and its buyers. Their existence goes beyond simply complying with international trade regulations; more than that, the use of HS Tariff Codes on eBay significantly impacts eBay’s credibility among its users worldwide.

“What is HS Tariff Code eBay” also provides practical steps for sellers to find, determine, and assign HS Tariff Codes to their international products on eBay. It also outlines further steps for listing HS Tariff Codes on eBay, as well as tips for determining the correct HS Tariff Code on eBay. In conclusion, in international trade, understanding and implementing HS Tariff Codes appropriately can benefit all parties involved—eBay as the international trading platform, sellers, and buyers.

Frequently Asked Questions

1. Who provides the HS Tariff Code?

The HS Tariff Code is an international goods classification code, managed by the

World Customs Organization (WCO).

2. How many digits are there in the HS tariff code?

The HS Tariff Code consists of six digits, with the first two digits describing the chapter. Combined with the following two digits, it becomes a four-digit code, describing the heading. The final two digits, called the subheading.

3. Is the HS Tariff Code the same for every country?

Yes and no. The first six digits are the same as the WCO standard. However, the next two to four digits may vary from country to country.

4. Why is the HS Tariff Code Important on eBay?

The HS tariff code is important for eBay, sellers, and buyers because it can estimate import costs, maintain user credibility and trust, and even determine the smoothness of cross-border transactions.

5. Is there a quick way to find the HS Tariff Code for sellers on eBay?

Use hscodematch.com → describe your product in detail → pay attention to the country of origin and destination by also looking at the national regulations that apply in that country.

6. Where is the HS Tariff Code listed on eBay?

On the product page, alongside the detailed product information.

7. What are the important tips for determining the correct HS Tariff Code?

The article “What is HS Tariff Code eBay” summarizes five key tips for correctly determining HS Tariff Codes. However, two of the most crucial tips relate to selecting the right and official external website and providing detailed descriptions of internationally traded products.

Oct 24,2025

Oct 24,2025  By admin

By admin