What is a Partner Government Agency (PGA)?

Partner Government Agency (PGA) is a government institution in a country that is involved in managing the international trade process, other than the customs authority. These institutions work side by side with the customs authorities to regulate the criteria of certain commodities before entering the national border. Therefore, the tasks of these agencies do not overlap with those of the customs authority in a country.

The difference between the customs body and the Partner Government Agency is the role of these institutions. Customs body has the authority to direct checking and assess the imported goods physically from other countries at the seaport or airport, or the land border between two or more countries. Meanwhile, the PGA has the power to decide whether certain goods are eligible to enter the country or not, and the customs officer will execute the decision of the PGA.

PGA for Goods Import and Export

As government bodies that are in charge of import and export, PGAs are a supplement for the customs authority in a country. PGAs will assist the customs agency to ensure that the process of importing goods from other countries runs smoothly and complies with the customs regulations. They have responsibilities based on their competency that are still related to the import and export process. These are the key responsibilities of the PGAs for goods import and export.

- Regulations and Compliance: Setting up the regulations is the main focus of the Partner Government Agency in the export and import process. They are the one who has the right to establish the specific regulation of safety and health standards on a certain product that they have control of. For example, the food institution in a country has control of the standard of pharmaceuticals and medicine products can be permitted to enter the country.

- Inspection and Certification: Not only set up the regulations, but PGAs are also involved in the physical checking with the customs officers to ensure that the imported products meet the standards of the country. They also provide the certification of certain products before they are permitted to move into the country. For example, the agriculture authority in a country is conducting an inspection in a seaport to assess the standard of the real condition of the agricultural products before moving into the country.

- Established the Guidelines: PGAs are the ones who have the responsibility to provide information and guidelines on the export and import of certain products. Therefore, the exporter or importer can receive information from PGAs to navigate the complicated process of export and import. For example, the food authority provides information and guidelines for business that wants to import medicine products from other countries.

USA Partner Government Agencies

The customs authority in the United States is called Customs and Border Protection (CBP). The CBP has collaborated with several Partner Government Agencies in order to enforce the customs regulations in the United States. These Partner Government Agencies have their own tasks based on the specific expertise of the imported products. Here are the lists of the Partner Government Agencies in the United States.

Department of Agriculture (USDA)

The Department of Agriculture (USDA) is one of the PGAs that is specific to the agricultural sector. This government institution has the authority to ensure that imported agricultural and livestock products from other countries meet the standards in the United States. The main tasks of this department are to prevent the entry of pests and other plant diseases that might cause damage to the local agricultural industries in the United States. This department supervises several branches of agencies, including the Animal and Plant Health Inspection Service (APHIS), Food and Safety Inspection Service (FSIS), Agriculture and Marketing Service (AMS), and Foreign Agricultural Service (FAS).

Department of Health and Human Services (HHS)

The Department of Health and Human Services is one of the crucial departments that works alongside CBP to prevent the flow of illegal drugs, medicine, and pharmaceutical products from entering the US market. On the other hand, this department also prevents the spread of disease from live animal entrants into the US to protect the local animals and also the US citizens. HHS oversees the two agencies, including the Federal Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC).

Department of Commerce

The Department of Commerce has the responsibility to control the importation of seafood and textile products from other countries. This department also has a task to promote fair trade and compliance with international law and agreements. The Department of Commerce is overseeing several agencies, including the National Marine Fisheries Service (NMFS), Enforcement and Compliance within the International Trade Association, and the Office of Textiles and Apparel.

Environmental Protection Agency (EPA)

The Environmental Protection Agency (EPA) has the authority to control the import of goods to meet the standards of certain chemical substances, ozone-depleting substances, fuels, engines, vehicles, and hazardous materials from other countries. EPA has the responsibility to ensure that the imported products are not harmful to the environment in the United States.

Consumer Product Safety Commission

The Consumer Product Safety Commission (CPSC) is the department that is responsible for the safety of the products that enter the United States. This department has an agency, namely, the Office of Import Surveillance (EXIS), whose main task is to determine and examine the imported consumer products alongside the CBP officers.

Department of Transportation

Department of Transportation oversees the agency called the National Highway Traffic Safety Administration (NHTSA), whose main task is to examine cars or motorcycles imported from other countries into the US.

Department of Justice

The Department of Justice supervises two agencies that work alongside CBP, including the Drug Enforcement Administration (DEA) and the Bureau of Alcohol, Tobacco, and Firearms (ATF). The ATF is responsible for controlling the importation of alcoholic beverages, firearms, and cigarettes. Meanwhile, the DEA has the responsibility to control the flow of illegal drugs, including narcotics, into the United States.

Department of the Treasury

The Department of the Treasury has an agency that works side by side with the CBP, namely, the Alcohol and Tobacco Tax and Trade Bureau (TTB). This agency ensures that the imported alcoholic beverages, tobacco, and other trade comply with the duties and taxes before entering the US territory.

Department of Interior

The Department of Interior supervises the Fish and Wildlife Service to guarantee the safety and protection of wildlife in the US and internationally. This agency is responsible for checking the eligibility of exporting and importing wild animals to and from the US.

EU Partner Government Agencies

European Union (EU) Partner Government Agencies are the agencies that collaborate with the EU Customs Union (EUCU) officer in order to scrutinize the legality of the importation of goods from other countries to enter one of the EU member countries. These customs agencies are coming from the government institutions in each of the EU member countries. Therefore, the regulations from PGAs are based on each country and align with the EU regulations.

European Commission

The European Commission is the executive institution in the European Union. This institution is part of the three branches of the governing bodies of the EU, which have the same position as the European Parliament and the Council of the European Union. The European Commission has the principal role as the party that proposes and imposes new regulations in the EU. This institution can also evaluate and examine the regulations to determine whether they satisfy the business and citizens within the EU.

Access2Market Portal

Access2Market Portal is the specific website for all parties who want to conduct export and import to the EU countries. This website provides all of the information about international trade, such as tariffs, duties, procedures, etc, from countries outside the EU to the EU member countries. Therefore, this portal will help you to get to know more about the export and import process in the EU countries.

China General Administration of Customs of the People’s Republic of China (GACC)

The General Administration of Customs of the People’s Republic of China (GACC) is the customs authority in the People’s Republic of China, or China. Similar to other customs bodies, GACC has a responsibility to control, examine, and manage the goods from all countries entering China’s territory. Not only for goods, this agency has the authority to check the health condition of a person, animal, or plant from outside that are destined for China or vice versa.

Role of GACC in Customs Trade

GACC has a similar role to other customs all over the world. The GACC officer in charge of managing the port control, conducting anti-smuggling, collecting duties and taxes based on the certain goods valuation. The officers are also checking the health of people from other countries before entering China. This agency practices the sanitary and phytosanitary measures in order to protect the land and citizens in China.

Data provided by GACC

GACC also has the responsibility to provide data statistics based on the export and import processes in China. This agency publishes the monthly or annual data on http://english.customs.gov.cn, such as total imports and exports, trade partners, etc. The data provided by the GACC helps exporters and importers get to know about international trade from and to Chinese territory.

United Kingdom Partner Government Agencies

United Kingdom (UK) Partner Government Agencies are the government institutions that are involved in helping the customs agency in the UK, HM Revenue and Customs (HMRC). These agencies have the principal tasks based on their specialities. For instance, the Border Force is responsible for enforcing the customs regulations and controlling the goods and foreign citizens entering the UK.

HM Revenue & Customs

HM Revenue & Customs (HMRC) is the government institution that is specifically responsible for customs and tax payments in the United Kingdom. The main task of HMRC is to collect taxes from many sources and customs duties in export and import processes. In addition, HMRC has responsibilities to impose the national minimum wage and provide child benefits for UK citizens. This agency also publishes data statistics about the taxes and customs duties in the UK.

EORI Number

EORI number is an abbreviation for Economic Operators Registration and Identification number that is used for the export and import process. This number is required to move goods from Great Britain (England, Scotland, Wales) to the Isle of Man, Northern Ireland, the Channel Islands, and the member countries of the EU. Also, this EORI number is used to move products from Northern Ireland to the EU countries. The EORI number can be obtained from the customs authorities in the UK or the customs authorities in each EU country.

Importing Goods to the UK

Importing goods to the UK requires some steps. The first step is to check the goods that you want to move to the UK for personal use or as a gift. Then, get the EORI number and find a third party that can help you with the shipping and administration process from the origin country. Once the goods move in the UK, you need to get the goods from the customs authority and claim the VAT. You can check the full steps from the UK government here: https://www.gov.uk/import-goods-into-uk.

Exporting Goods from the UK

Exporting goods from the UK is quite similar to the process of importing goods from another country. First, you need to check the rules based on the goods and the destination of export. You also need an EORI number to export products from Great Britain. Then, decide who can help you ship the products and who can receive the products in the destination country. Check this official website from the UK government for more detailed steps: https://www.gov.uk/export-goods.

PGA Notification Service

For the importer or exporter, the latest information from the Partner Government Agencies is important. Finding this information is quite challenging due to the large amount of information and documents that need to be selected. Therefore, Jureem developed a Partner Government Agency Notification to answer this problem. The Partner Government Agencies Notification will give you the latest information based on the PGA regulations in the country that you are looking for. Here are the features from the Partner Government Agency Notification.

Real-time Data Search of Government Notification

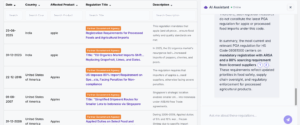

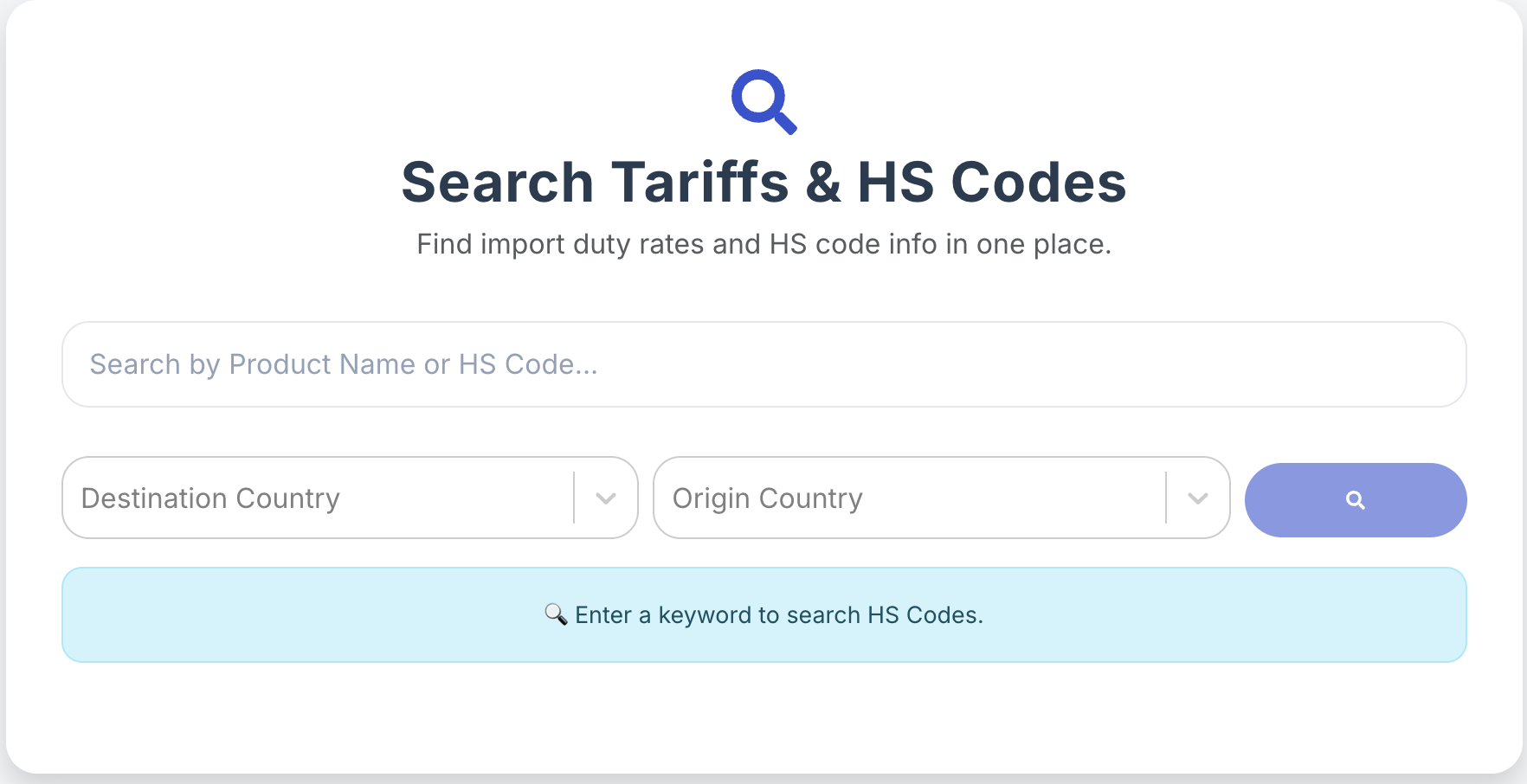

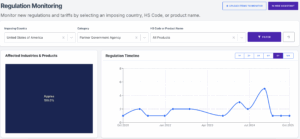

Using the Partner Government Agency Notification is easy. You can just type hscodematch.com into your browser. Then you can choose the Regulation Monitoring tool and type your specific goods and the country that you are looking for in the brackets. Regulation Monitoring will show you the latest news from the PGA based on accurate government sources. Regulation Monitoring is also equipped with a real-time data search, which allows you to know the latest regulations from a specific country. For example, this is a result of the PGA on Regulation Monitoring of apples in the United States.

Using AI to analyze PGA Notifications and ask questions via Chatbot

After finding the specific product and country. You can choose one of the results from the Regulation Monitoring. This will lead you to the detailed information about the PGA news from the specific country. In the Regulation Monitoring, you can easily use an AI Assistant to ask any questions related to the specific regulation.