Import Procedure in Saudi Arabia

Saudi Arabia is one of the destinations for many imported goods from around the world. Many countries see Saudi Arabia as one of the best and stable markets to sell their products due to its large and high-income population in the Middle East. However, this country is considered one of the strictest in the Gulf region or the Middle East in regulating the imported products from other countries before permitting them to enter its territory. You might be wondering what the process is and how to import products to Saudi Arabia, and what things you should avoid. This article will explain and assist you to be preparing for the import procedure in Saudi Arabia.

Why should countries export goods to Saudi Arabia?

Saudi Arabia is one of affluent countries in the Middle East due to its vast oil reserves. With the steady economic growth driven by the oil industry, the purchasing power of the people in Saudi Arabia is increasing each year. Besides, with a population of around 35 million people, this becomes a great opportunity to export goods to Saudi Arabia.

One of the interesting parts of exporting goods to Saudi Arabia is the government’s Vision 2030 for diversification. Therefore, the Saudi Arabian government launched several programs aimed at alleviating the dependency of Saudi Arabia on the oil-based economy. These programs, including the development of the service, tourism, and other industrial sectors, are a new opportunity for many countries to export their products in order to supply the needs in Saudi Arabia.

Who is responsible for the import procedure in Saudi Arabia?

The import procedure in Saudi Arabia is regulated by the Zakat, Tax, and Customs Authority (ZACTA), and this body is part of the Ministry of Finance. This authority not only provides the customs laws, but it also has the function to collect Zakat or charity obligation for muslims and the regular tax in Saudi Arabia. Thus, most of the services related to the import procedure in Saudi Arabia are handled and organized by ZACTA.

Similar to other countries, the customs authority or ZACTA in Saudi Arabia is not the only body that is responsible for the import process in the country. ZACTA is helped by the other government agencies to establish the regulations for the import procedures in Saudi Arabia based on the local policies, political, and economic interests of its country. These government bodies are called Partner Government Agencies or PGAs.

Partner Government Agencies (PGAs) in Saudi Arabia

Partner Government Agencies (PGAs) are the government authorities that have the responsibility to assist the customs agency. These bodies are part of the department under a specific ministry to establish the regulations and ensure that the imported goods from other countries comply with the law. PGA is also involved in conducting the physical inspections alongside customs officers at the international border or international ports and airports. Saudi Arabia has its own PGAs from many ministers to ensure and check the standard of goods before moving into its country. This is the list of PGAs that assist the customs agency in ensuring the import procedure in Saudi Arabia.

1. Saudi Standards, Metrology and Quality Organization (SASO)

Saudi Standards, Metrology, and Quality Organization (SASO) is an agency that has a function to set up the standards and check the quality control of the raw material from other countries. This agency also sets the procedure of evaluation, measurement, and licensing the goods based on the Saudi Accreditation Committee (SAC). SASO actively works with other institutions and private agencies to ensure a high-quality standard for people in Saudi Arabia. SASO is also a member of the International Organization of Standardization (ISO) and other international standardization organizations.

2. Saudi Food and Drug Authority (SFDA)

The Saudi Food and Drug Authority (SFDA) is an agency in Saudi Arabia that has the task of ensuring that food, drugs, agricultural, and electronic products from other countries meet the standards in the country. SFDA also requires that the imported food and medicine, or cosmetic products from other countries, must include a halal certificate approved before entering and be sold in Saudi Arabia.

3. Communications and Information Technology Commission (CITC)

Communication and Information Technology Commission (CITC) is an agency in the Saudi Arabian government to oversees the telecommunications technology in the country. This agency will issue a mandatory permit license for all imported telecommunication, IT equipment, and electronic devices as an import procedure in Saudi Arabia. CITC has published the specifications of imported electronic devices from other countries in order to enter the country.

4. Ministry of Commerce, Saudi Arabia

The Ministry of Commerce, Saudi Arabia, is a ministerial government body that regulates the import procedure in Saudi Arabia. This minister provides the standard and the regulations before importing products from other countries. The Ministry of Commerce has the authority to issue licenses to the importers in Saudi Arabia before involving international trade.

5. Saudi Ports Authority (MAWANI)

Saudi Ports Authority (MAWANI) is an agency that manages and operates the ports in the Kingdom of Saudi Arabia. MAWANI has the authority to permit the ships before entering or departing from the ports in Saudi Arabia. This agency is operating nine ports in Saudi Arabia, and 6 of the 9 ports are considered commercial ports.

6. General Authority of Foreign Trade (GAFT)

The General Authority of Foreign Trade (GAFT) is considered a new government entity in Saudi Arabia that was established in 2019. This entity has a function to develop and formulate the regulations in international trade in Saudi Arabia, including the import procedure in Saudi Arabia.

7. Ministry of Environment, Water, and Agriculture, Saudi Arabia (MEWA)

Ministry of Environment, Water, and Agriculture (MEWA) is a government entity in Saudi Arabia that was established to ensure the protection of the environment, water, agriculture, livestock, and fisheries in the country. MEWA is also assisting the customs agency to ensure that the imported products from other countries meet the environmental standards, and the livestock, agricultural, and fisheries products do not contain any kind of disease.

8. Ministry of Health, Saudi Arabia (MOH)

The Ministry of Health of Saudi Arabia is overseeing and setting the standards and regulations of pharmaceutical or medicine products from other countries before moving in Saudi Arabia. This ministry works hand in hand with the SFDA to ensure that the health products meet the local standard.

Free Trade Agreements (FTAs) involving Saudi Arabia

Saudi Arabia has developed some free trade agreements (FTAs) with other countries. However, most of the FTAs of Saudi Arabia are Multilateral FTAs instead of bilateral FTAs, which were developed through the membership of the Gulf Cooperation Council (GCC). The GCC has six member countries, including the Kingdom of Saudi Arabia, Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates (UAE).

The GCC was established by the countries in the Gulf region or the Middle East in 1981. This cooperation is based on the geographical proximity and the similarities of the political systems of those countries. Through GCC, the countries have established the GCC customs union to standardize the procedure and reduce tariffs on imports between the member countries. These are the FTAs involving Saudi Arabia and the GCC.

1. GCC-Singapore Free Trade Agreement (GSFTA)

GCC-Singapore Free Trade Agreement (GSFTA) was established on 15 December 2008, and it came into force on 1 September 2013. Through this FTA, the member countries have agreed to reduce the tariff from Singapore to GCC countries up to 99 percent. This is important to promote business and trade among the member countries of the GCC with Singapore and vice versa.

2. GCC-EFTA Free Trade Agreement

GCC-EFTA (European Free Trade Area Association) FTA was established on 22 June 2009 in Norway, and this agreement has been implemented since 1 July 2014. EFTA is an association of European countries outside the European Union (EU), which consists of Iceland, Liechtenstein, Switzerland, and Norway. This agreement relates to goods, services, investments, intellectual property, etc.

3. New Zealand-GCC Free Trade Agreement

The New Zealand-Gulf Cooperation Council Free Trade Agreement (NZ-GCC FTA) was developed to promote the economic ties of New Zealand and GCC countries. This agreement has a background of the project of GCC countries to diversify their economy from oil-based to other sectors. Therefore, they’re considered to create new opportunities to accelerate those programs and promote the business relations with New Zealand.

4. GCC-Lebanon Free Trade Agreement

GCC-Lebanon FTA was enforced in 2004 to promote the economic relations between the GCC member countries and Lebanon, as a neighbour country in the Middle East. This FTA is established to eliminate the tariff on most products and to explore the economic potential between the two parties.

5. Ongoing proposal of GCC FTAs

Other than the GCC agreements above, there are some proposals of FTA agreements involving GCC that are still in progress. The proposal GCC FTA that still being negotiated between several countries, such as China, India, Pakistan, Indonesia, Australia, South Korea, the United Kingdom, and the European Union.

Requirement documents for the import procedure in Saudi Arabia

After knowing the ZACTA, PGAs, and FTAs in Saudi Arabia, you also need to know the requirement document for the import procedure in Saudi Arabia. Before importing products from other countries to Saudi Arabia, there are compulsory documents that you need to fulfill to be successful through the customs process, as follows:

- Commercial Invoice: This document is actually a detail of the products that are intended to be sent to Saudi Arabia. This document must include HS codes, information about the seller, and the buyer. The important thing is that the information from this document must be the same in other documents.

- Certificate of Origin (CoO): This document is proof that a product is manufactured or made in a specific country. CoO is essential for the imported products because it is a signed that will be noticed by the customs officers to assess the duties and taxes.

- Bill of Lading (BoL) or Air Waybill (AWB): This is a mandatory document of shipping that is made by the freight forwarders. If the shipment process uses sea transportation, it must add the Bill of Lading (BoL), and if using air freight transportation, this must include the Air Waybill (AWB).

- Packing List: This document contains the information about the list of packaging products that are intended to be sent. The packing list must be clear and detailed about the packing materials, weights, and dimensions

- Importer Commercial Registration (CR): This document is proof that the importer has a permit from the Ministry of Commerce to import products from other countries to Saudi Arabia.

- Conformity Certificate: This is the document that certain imported products meet the specific standards in Saudi Arabia that were developed by SASO.

- SABER Registration Document: This document can be accessed through the SABER platform from the government of Saudi Arabia. This registration document is proof that the products meet the standards of SASO and contain the details of the products.

- SFDA/CITC Permit License: The SFDA Permit License is a document issued by the SFDA for food, cosmetics, and pharmaceutical products from other countries. Meanwhile, the CITC Permit License is issued by the CITC for electronic products.

- Halal Certificate: Due to the muslim country, Saudi Arabia requires food and livestock products to have a halal certification from the recognized bodies.

- Health Certificate: This document is released by the Ministry of Health (MOH) in order for the meat, poultry, and other food products to meet the health standards in Saudi Arabia.

- Insurance Certificate: This document is not mandatory, but there are some products or goods that require showing an Insurance Certificate as proof that it covered by the insurance during the shipping process.

- Custom Declaration: This document can be filled out through the FASAH website and is needed by the customs authorities in Saudi Arabia.

- Arabic Labeling Proof: Due to Saudi Arabia using Arabic as an official language, the products need to have Arabic labels to make it easier for officers to check the ingredients, product names, expiration dates, etc.

Prohibited imported products in Saudi Arabia

Since Saudi Arabia is a muslim country, the government imposes strict regulations on international trade based on Islamic law and local cultural values. The Saudi government develops strict regulations as part of the import procedure in Saudi Arabia and mentions the prohibited materials to protect the population and their interests. This is the list of prohibited and restricted goods to enter Saudi Arabia, as follows:

- Narcotics and other kinds of narcotic products, such as marijuana, cocaine, heroin, and others

- Fireworks and all types of these products.

- Alcohol for consumption which banned based on Islamic values.

- Weapons and other types of explosive materials

- Any goods containing pornographic content, such as vulgar pictures, porn movies, sex toys, and others.

- Any items with hidden cameras

- Nutmeg because it can cause hallucination if consumed in large quantities

- Live animals or insects

- Pork meat or any food containing pork which banned due to the contradiction with the Islamic values.

- Religious materials, such as iconography other than Islam.

- Religious book other than an Islamic book.

- Goods containing Israeli flags because of the strained relations between Saudi Arabia dan Israel

- Gambling items, such as cards, dice, gambling machinery, or others.

- Distillery equipment

- Dead animals or parts of the animal bodies, including skins, organs, etc

- Wireless equipment and radio transmitter devices

- Products containing perfume

- Used clothing

- Frog meat is deemed as haram by Islamic law.

- Goods containing or produced using animal blood

- Hazardous materials, such as pesticides, fertilizers, and other products, contain hazardous chemicals.

- Counterfeit products

- Electronic cigarettes and other vaping materials

- Drones without the approval of the authorities in Saudi Arabia

- Chewing smoke materials

- Huge quantities of jewelry without a permit, such as diamonds, gold, and other

You need to be careful and comply with the import procedure in Saudi Arabia because if the customs and local officers find that kind of prohibited items, you will have to deal with several consequences. The products will be confiscated, a large amount of fines, and in the worst-case scenario, it could bring you to imprisonment in Saudi Arabia. In order to be safe, you need to check the ZACTA website to know the latest requirements and import procedure in Saudi Arabia.

Platforms to facilitate the import procedure in Saudi Arabia

The government is improving the standard regulations for the export and import procedures in Saudi Arabia by implementing digitalization. Therefore, you do not need to be worried about the list of compliance and laws to import products to Saudi Arabia. You can see on the website of the government to know the instructions to export goods to Saudi Arabia. The government uses two platforms that you need to visit and register for one of the import procedures in Saudi Arabia.

1. Saber Electronic Platform

Saber Electronic Platform is one of the comprehensive online platforms that are required by the Saudi government to register imported goods or products. This platform is managed by the SASO, and it will give you access to speed up the process of getting the certificate of conformity from the SASO and other institutions. This platform is easy to use, and you only need to register and fill out the form based on your product type.

2. Fasah Platform

Fasah Platform has different functions from the Saber. This platform is developed by the Saudi Arabian government to manage and organize the shipping process. This allows you to submit a declaration and coordinate the ports and airports to land your products in Saudi Arabia. The most interesting thing about this platform is that it is equipped with tracking status to ensure where is the location of your product. Through this platform, you can pay the customs fees and check the customs clearance status electronically.

Based on the explanation above, Saber and Fasah have different functions and work as complementary. Saber is the first step of the import procedure in Saudi Arabia, which is specifically for registering imported products and obtaining permitted licenses from SASO to ensure the safety and quality standards in Saudi Arabia. Then, they proceed to use Fatah as an online platform to get the issuance and permission by the ZACTA authority to enter the products into Saudi Arabian territory.

Step-by-step import procedure in Saudi Arabia

After knowing the authorities, prohibited products, and certain platforms in the import procedure in the Kingdom of Saudi Arabia. We know that the import procedure in Saudi Arabia is quite challenging because it requires special treatments, especially for beginners or people who have never been involved in exporting and importing products in Saudi Arabia. However, the import procedure in Saudi Arabia is basically similar to other nations, but it has different platforms and restrictions on some products. These are the step-by-step instructions for exporting and importing products or goods in Saudi Arabia.

1. Identification of product requirements to enter Saudi Arabia

Before considering importing products, you need to recognize and review the import procedure in Saudi Arabia. First, determine the HS code by the classification of the products in Saudi Arabia. This procedure is crucial to determine the tariff based on the country of origin. If there is an FTA between the country of origin and Saudi Arabia, you can use it to reduce the tariff.

Identifying the import restrictions and quotas for importing goods from the country of origin to Saudi Arabia. The regulations on products rely on the type of products, such as food, pharmaceutical, and medical should obtain certification from SFDA and SASO. Meanwhile, the electronic devices should obtain a license from CITC and SASO.

2. Looking for importers in Saudi Arabia

After identifying the requirements, the foreign companies or the exporters should reach out to the local agents or importers in Saudi Arabia. This is the next import procedure in Saudi Arabia in order to make the products run smoothly and safely. The importers should choose the right agents to ensure that their products are handled by professional agents. The local importers should be on the list of the Ministry of Commerce to avoid fraudulent and other undesirable events.

3. Getting the licenses and certificates from the Saudi government

Before proceeding to the shipping process, the exporter should register their products through the Saber platform. These processes are required to get the licenses from the Saudi Arabian government institutions and SASO. This process is quite long because the product will undergo several assessments and inspections. Besides, you need to be prepared for other documents, including Certificate of Origin, Commercial Invoice, Packing List, Bill of Lading or Airway Bill, and Certificate of Compliance.

4. Shipping process to Saudi Arabia

After all of the steps above are done, we can proceed to the shipping process by ensuring all the shipping documents are complete and accurate. Also, take a look at the labeling of products to make sure that the products have the appropriate labeling standard using the Arabic words. If all of the documents and requirements are sufficient, you need to contact the freight forwarders to arrange the transportation and determine the best option of transportation through sea, air, or land.

5. Submitting the import declaration to ZACTA

Once the product arrives in Saudi Arabia, you need to submit an import declaration via the Fasah website. You need to register the products and fill in the forms and details of the products. This process can be handled by the local agents or customs brokers in order to make the process easier. Other than that, customs brokers will help you to solve the customs problems, if any, and the products can be entered into Saudi Arabia. Then, you need to pay customs duties and taxes based on the assessment from ZACTA. There is are possibility that the products are inspected physically by ZACTA and the PGAs in Saudi Arabia.

6. Customs clearance and delivery process

Once the requirements are met and all duties and taxes are paid, ZACTA will approve the goods to enter Saudi Arabian territory and give customs clearance as part of the import procedure in Saudi Arabia. Then, the products can be transferred into the warehouse by selected local importers.

7. Post-import compliance in Saudi Arabia

Even after all of the customs processes for the import procedure in Saudi Arabia are done, please keep all of the documents for at least 5 years. This is important for auditing purposes and to check if there are any irregularities in customs procedures or miscalculation of the duties by the customs officers. The last thing you need to ensure is that the imported products already comply with the regulations in Saudi Arabia and meet the standards. After that, the products are eligible to be sold in the stores in Saudi Arabia.

How to find HS code and tariff in Saudi Arabia using HS Code Match

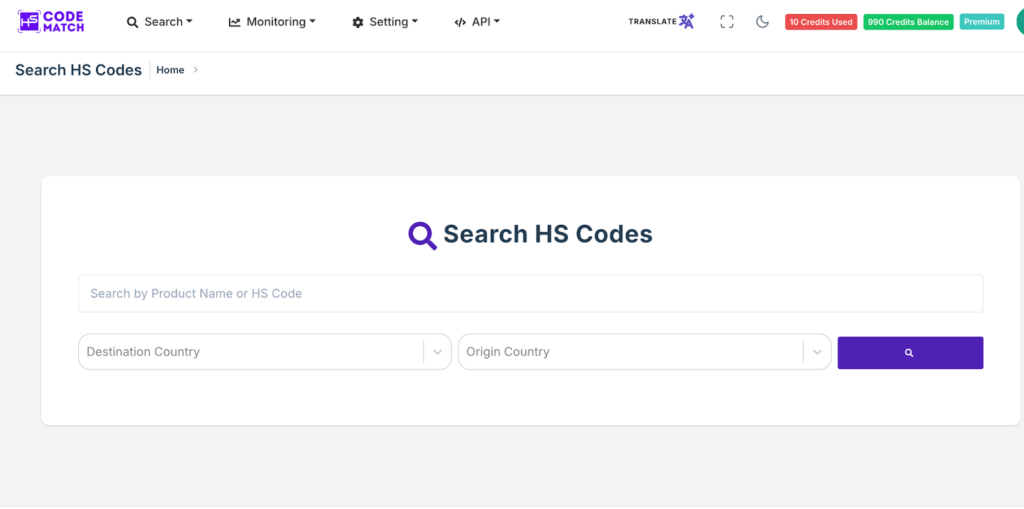

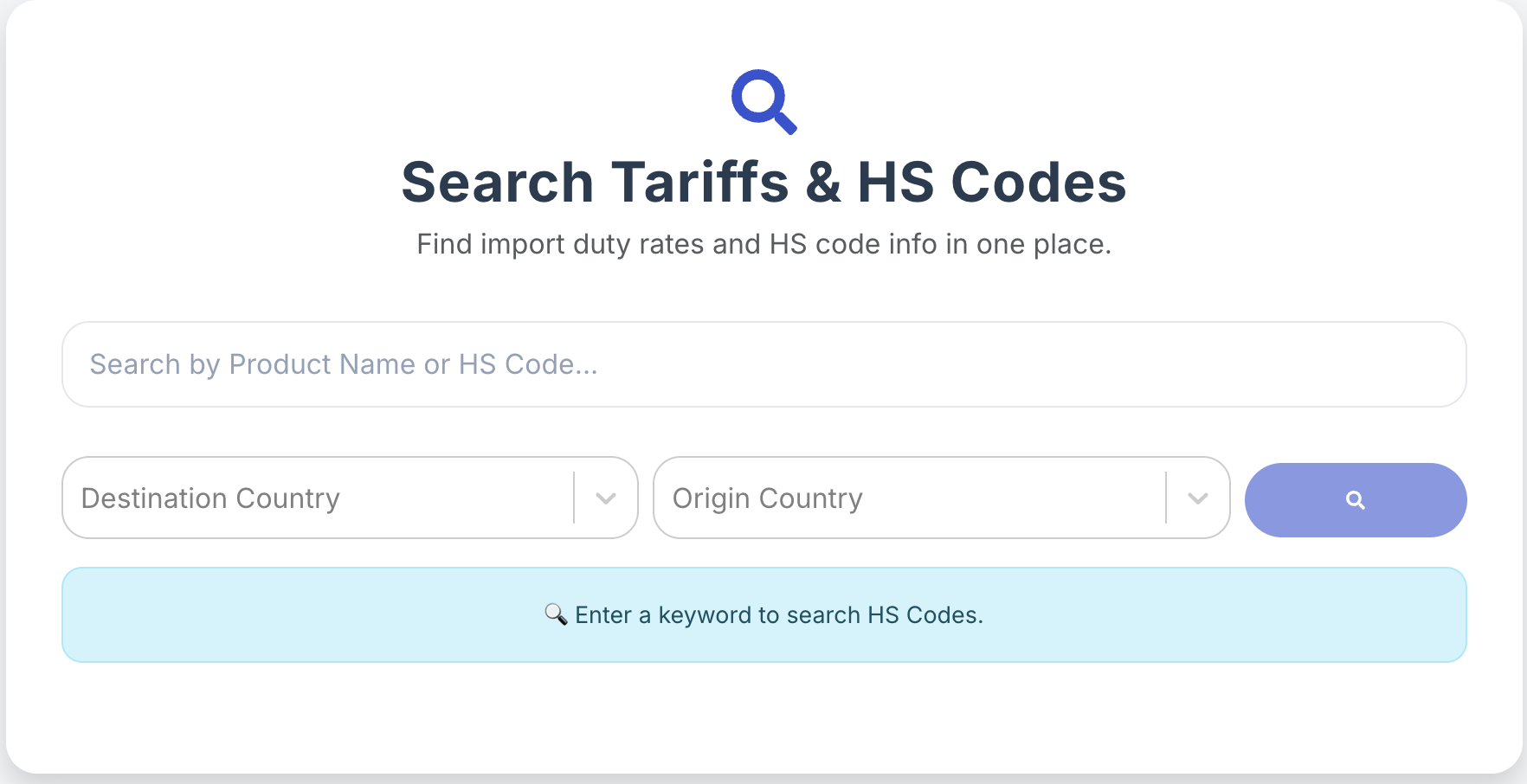

We know that the import procedure in Saudi Arabia is not easy, especially in finding the HS code and tariff. Therefore, Jureem HS Code Match provides the service to ease mundane and long processes in the importation of products to Saudi Arabia. These are the instructions for finding HS codes and tariffs in Saudi Arabia using HS Code Match.

- Set the product name and the countries in the HS Code Match

Finding the HS code as an import procedure in Saudi Arabia using HS Code Match is easy. You just need to open the HS Code Match through your browser on your computer. Then, fill in the destination country, origin country, and the product name or HS code of a specific product if you already know it.

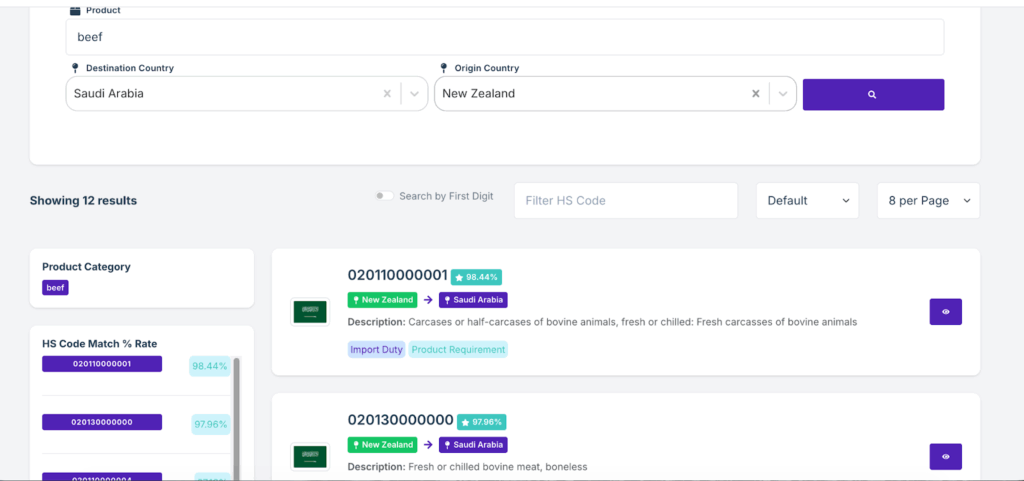

- Check the best results and preferences in the HS Code Match

After setting the beef as the product name, Saudi Arabia as the country destination and origin country, and New Zealand. We can find the list of HS codes based on the most preferred tariff rate for the import procedure in Saudi Arabia. You can select the tariff that you need to know in detail by clicking on one of the rates.

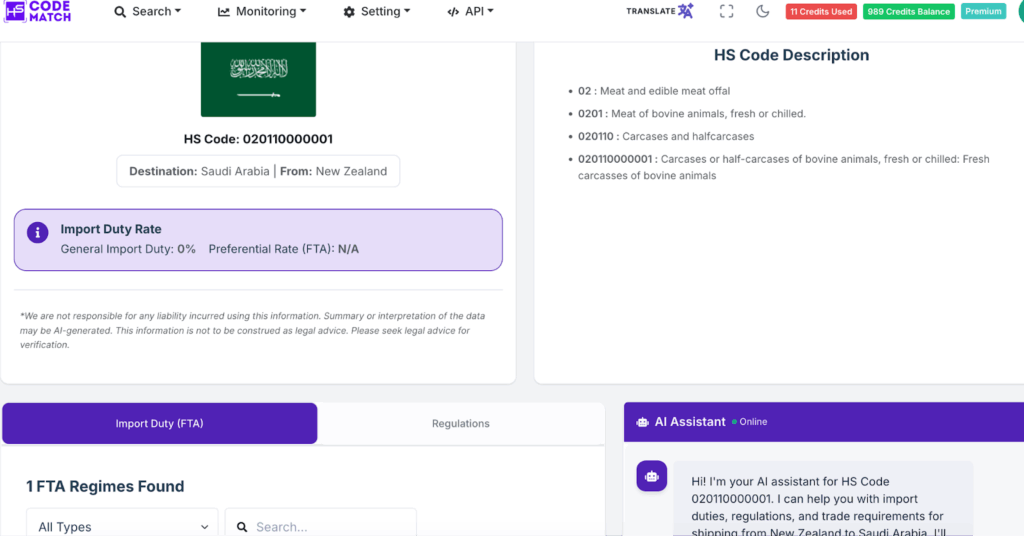

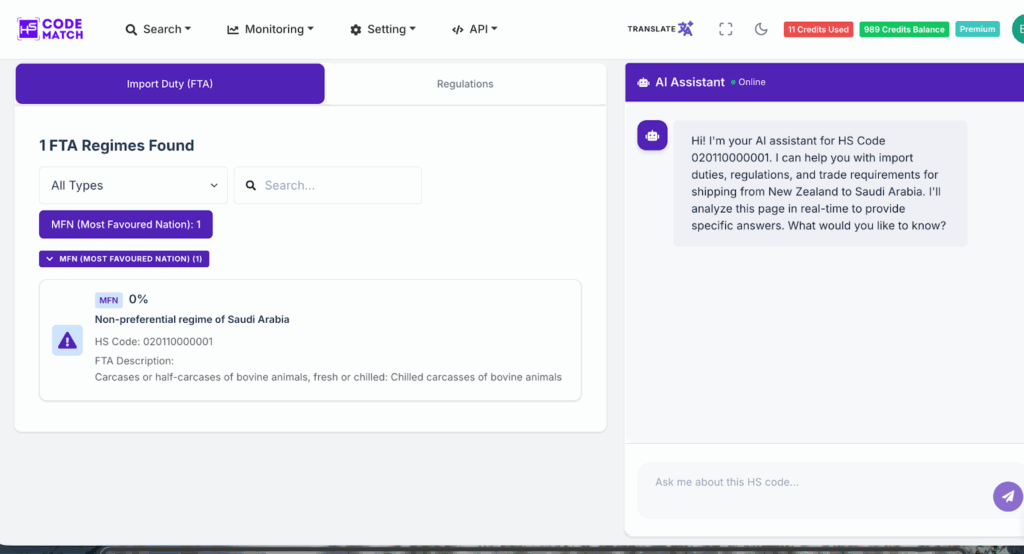

- Check the detailed regulations and duties

After selecting one of the tariff rates, you can see the HS code description and the import duty rate. You can see that the tariff rate to export beef from New Zealand to Saudi Arabia is 0 percent. This data is from the document regulations of the Saudi Arabian government.

- Use the AI Assistant to find the specific part of the regulation

If you want to know more about the regulations document for the import procedure in Saudi Arabia. You can get into the specific part of the regulation by using the AI Assistant. This feature allows you to chat with the document in order to find the specific data or anything related to the document.

After looking at the step-by-step instructions above, you can see that using HS Code Match to find HS codes and tariff rates for the import procedure in Saudi Arabia is very easy and convenient. You only need to search like using a common search engine, and type the countries that you need to export and import products to.

Conclusion

The import procedure in Saudi Arabia is quite challenging, especially for beginners or a party that has never been involved in it. The Saudi Arabian government is setting some restrictions and prohibiting goods based on Islamic laws. However, these problems can be solved by taking a look at the import procedure in Saudi Arabia. The Kingdom government has also developed digital platforms such as Saber and Fasah to make the import process easier than before. As long as the requirements are met and your product is not part of the list of prohibited products, you do not need to worry about the risk that your products will be rejected or confiscated. You can also use the services of a customs broker to help you with the customs process in Saudi Arabia.

Frequently Asked Questions:

1. Why do people consider importing products to Saudi Arabia?

Saudi Arabia is one of the high-income countries in the Middle East and the world. It also has a stable economy and steady economic growth, which increases the purchasing power. Thus, most businesses and countries see that selling their products to the Saudi Arabian market is profitable.

2. What are the platforms to assist the export and import process in Saudi Arabia?

There are two online platforms to assist importers or exporters with the import procedure in Saudi Arabia, which are called Saber and Fasah. These platforms have different functionality, and they are integrated with each other to make the importation process in Saudi Arabia easier than before.

3. Why should you understand the import procedure in Saudi Arabia?

Understanding the import procedure in Saudi Arabia is important. This will help you to avoid some kind of problem with customs and the PGAs. If you do not dive deeper and do not realize some miscalculation or a lack of some documents, it will lead to serious consequences.

4. Is there any restriction on importing food products to Saudi Arabia?

Yes, absolutely. Since Saudi Arabia implements Islamic laws and different cultural values, this is an important part of the import procedure in Saudi Arabia. Therefore, you need to consider some of the restrictions and prohibited products to enter the Saudi market. This is essential to identify before importing products in order to avoid loss or confiscation.

5. What is the longest import procedure in Saudi Arabia?

The longest import procedure in Saudi Arabia might be registration through Saber and inspection of the eligibility of a product before moving into the country. This procedure needs a comprehensive inspection to check whether it complies with the local standard or not.

6. What are the particular restrictions on importing products in Saudi Arabia?

Saudi Arabia implements Islamic laws which does not allow pork, frog meat to enter its territory. It also prohibits pornographic movies, videos, or pictures from entering the country due to being contrary to Islamic law and moral standards in Saudi Arabia.

7. Are there any FTAs involving Saudi Arabia?

Yes, the free trade agreements involving Saudi Arabia were agreed through the Gulf Cooperation Council (GCC) membership, and there are four FTAs agreed by the GCC these days. However, Saudi Arabia does not have a bilateral FTA with other nations in the world.

8. What is the authority that is responsible for the import procedure in Saudi Arabia?

Zakat, Tax, and Customs Authority (ZACTA) is the authority that is responsible for the importation of goods from other countries and is responsible for the import procedure in Saudi Arabia. This body is helped by other institutions called Partner Government Agencies (PGAs) to enforce the standard and the regulation to protect the consumers and their market from illegal practices, such as antidumping and others.

9. What is the authority that is responsible for assessing Saudi Arabia’s food imports and pharmaceutical products?

The Saudi Food and Drug Authority (SFDA) is the agency that is responsible for assessing and ensuring the standard of food, medicine, and pharmaceutical products entering Saudi Arabia. This agency is conducting the inspection in the field and works hand in hand with the customs body and the Ministry of Health of Saudi Arabia to protect the local consumer.

10. What is the tool that can be used to find HS codes and the latest regulations in Saudi Arabia?

You can use HS Code Match to identify to find the HS code in Saudi Arabia. HS Code Match has a tool called the Customs Insights Search Tool, which will give you insights regarding the latest regulations from the Saudi Arabian government. You should know the recent regulations in order to make the export and import process run smoothly.

Find and Match the Right HS Code for Your Products.

Try Our App

Oct 24,2025

Oct 24,2025  By admin

By admin