What is a tariff?

Tariffs are duties or import taxes on products from the origin countries imposed by the government of the destination country. These tariffs are important for an international trade of a country because they can be used by the government to control the price of a specific imported product or service on the domestic market.

Tariff rates are commonly a percentage of a product price. This tariff will automatically increase the imported product price because it is paid by the customers through a higher price imposed by the businesses in the destination country. This condition makes the locally produced product cheaper and more competitive. However, if the tariff is increased dramatically, the imported product would be less competitive, and the demand would shrink significantly due to the higher price.

Not only for protecting the domestic industry, tariff is an economic tool for the government of a country as a reciprocal regulation. As we know, it happens these days that the United States imposes reciprocal tariffs on some of the imported products from other countries. These high tariffs are implemented because it is felt that those countries are conducting unfair and imbalanced trade with the United States. However, this practice can be solved or reduced through negotiations between the two countries.

The tariff is also an essential political tool for a country such as the United States. For instance, the United States imposes tariffs on its neighbors that have land borders, Canada and Mexico, to help stop illegal immigration and drug trafficking into the country. Thus, in order to reduce the tariff and defend their economic interest in maintaining their export products to the United States, these two countries were required to follow the demand of the United States.

The tariff rates are different based on geography because they vary from one country to another due to the economic and political interests of the specific countries. Some of the countries that have succeeded in reducing the tariff rate are due to the agreements between the two countries. Some countries offer investment or buy more specific products to balance the trade with the country that imposes a high tariff.

Implementation of tariffs has a heavy impact on the industry in countries around the world since the world is connected due to globalization. The tariff would change and transform international trade because it can interrupt the supply chains. Some of the companies are moving their production or assembly to countries that are impacted by a small amount of tariff rate. This is one of the ways to maneuver the tariff rate.

Not only relocating their industry to other countries, but some countries are also trying to shift their export to other markets in order to minimize the losses. This is the way to sustain the amount of exports of specific products. On the other hand, the shifting market is an effective to market diversification, protecting their industry, and making a country less dependent on exports to some countries. In addition, it can be implemented to maintain the revenue without being heavily interfered with by the policy on specific countries.

General Rate

The general rate is a basic or standard tariff that is implemented by a country for most goods imported from other countries. This rate does not have any preference or any special implementation in order to reduce the tariff rate. The general rate commonly used by a country for goods from a country with which it does not have trade relations.

MFN (Most Favored Nations) Rate

The Most Favoured Nations (MFN) rate is a tariff used by a country for all of the World Trade Organization (WTO) member countries. Hence, the MFN tariff is the highest tariff that can be applied to other WTO member countries worldwide. This tariff rate can be lifted if the country is a member of a special trade agreement, such as a customs union and a free trade area.

Preferential Rate

A preferential rate is a tariff that is implemented by a country for one or several countries with a lower tariff rate than the MFN rate. The preferential tariff rate is commonly implemented within the customs union and a free trade area. Therefore, a preferential rate is a reciprocal agreement between two or multiple countries. For example, a preferential tariff is imposed between the European Community, the Gulf Cooperation Council (GCC), the Southern Africa Customs Union, and the Southern Common Market (MERCOSUR).

Antidumping Rate

The antidumping tariff rate is a tariff rate levied by a country for a particular product to address the lower-priced products from other countries. This tariff rate is implemented to ensure that the price of imported products is not lower than the price of the domestic product. Therefore, the antidumping tariff rate will help the local products to be more competitive in competing with other countries’ products and protect the domestic industries in the local market.

Countervailing Rate

Similar to the antidumping rate, the countervailing tariff rate is a tariff rate imposed by a country on subsidized products from other countries. This countervailing practice is commonly supported by the government through financial assistance to make its exported products more competitive in the foreign market. This practice would lead to unfair business competition in certain countries’ domestic markets. Therefore, the government has implemented a countervailing tariff rate to protect the local industries.

What is an FTA (Free Trade Agreement)?

A Free Trade Agreement (FTA) is a trade agreement between two or multiple countries on regulations to reduce tariffs based on the interests of the countries. The implementation of FTA is an attempt to expand the business and promote the export and import between two or multiple countries. This agreement is conducted to decrease the hurdles to exporting products of certain countries to other countries.

FTA does not mean that the countries within this agreement should lift all the tariffs on specific products. They can still implement tariffs on certain products in order to protect their local industries. This agreement is mostly reciprocal; therefore, the two or multiple countries on the FTA agreement can reduce their barrier to boost their products to be exported and imported between countries.

Not only for goods, FTA can be implemented on services, intellectual property rights, etc. Several FTAs have been agreed upon by several countries around the world. Mostly, the FTA is agreed among the countries which has been known as allies or have similar political and economic interests. For example, the African Continental Free Trade Area (AfCFTA), United States–Mexico–Canada Agreement (USMCA), ASEAN Free Trade Area (AFTA, etc.

What are the rules of origin?

According to the WTO, the rules of origin are a standard to regulate certain products based on the country of origin or the country in which it is made. This rule is essential to decide the specific regulations on the products. Therefore, the rules of origin are applied in order to determine whether those products are eligible to receive the tariff reduction under the Free Trade Agreement (FTA) or not.

Additionally, the determination of rules of origin commonly uses the substantial transformation. This method is used to assess the goods that have undergone a change of form until they transform shape based on the characteristics until they are ready to be exported. Some types of products may change in the production process and have different ingredients from several countries of origin. For example, the car production is assembled in Country A, but the spare parts are from several other countries.

What are the certificate provisions?

Certificate provision is a certificate of origin of a product. This document is required for the international trade process and ensures that the products are eligible for a free trade agreement (FTA). Not all of the products should be claimed through the certificate provision forms. However, most of the members of FTA agreements accept some of the declarative statements to include specific data or information that those products are included in the FTA agreement between two or multiple countries.

The format of the certificate provision varies based on a certain FTA agreement. The detail of the certificate provision is usually stated in the FTA agreement documents. This document always includes the specific rules of origin (ROO) chapter, and some of the agreements give the template or the procedure for the certificate of provision. For example, the template of a certificate of origin from the United States government can be downloaded from the Customs and Border Protection (CBP) website.

What are the common terms under FTAs?

Not only are the two terms related to the FTAs. There are several other common terms relevant to the FTAs. Here are the lists of common terms under FTAs.

- De minimis is the standard minimum price of products that can be included in the duty or import tax. For example, in the United States, the threshold of de minimis is $800. Thus, a product under $800 is not eligible for import duty.

- Cummulation is a principle of goods to be produced in the same country or produced in several countries within the same member of FTA to the destination country.

- Roll-up, or known as absorption, is a principle to acquire the products from intermediate material from the other country of origin when it is used as a complement to the next manufacturing process.

- Duty drawback is a refund of the duty during the importation of goods. This refund can be claimed after the goods are exported or destroyed.

- Wholly obtained products are products that are completely produced in a single country of origin. For instance, a car is assembled in a country and all of the parts are from the same country of origin.

- Regional value content (RVC) is a rule that requires a specific percentage of goods to be from the FTA member countries. This rule is also about the value added from one or more countries under the FTA agreement.

- Margin of preference is the margin between the most favoured nation (MFN) tariff rate and the preferential tariff rate.

Our Tariff Rate Search

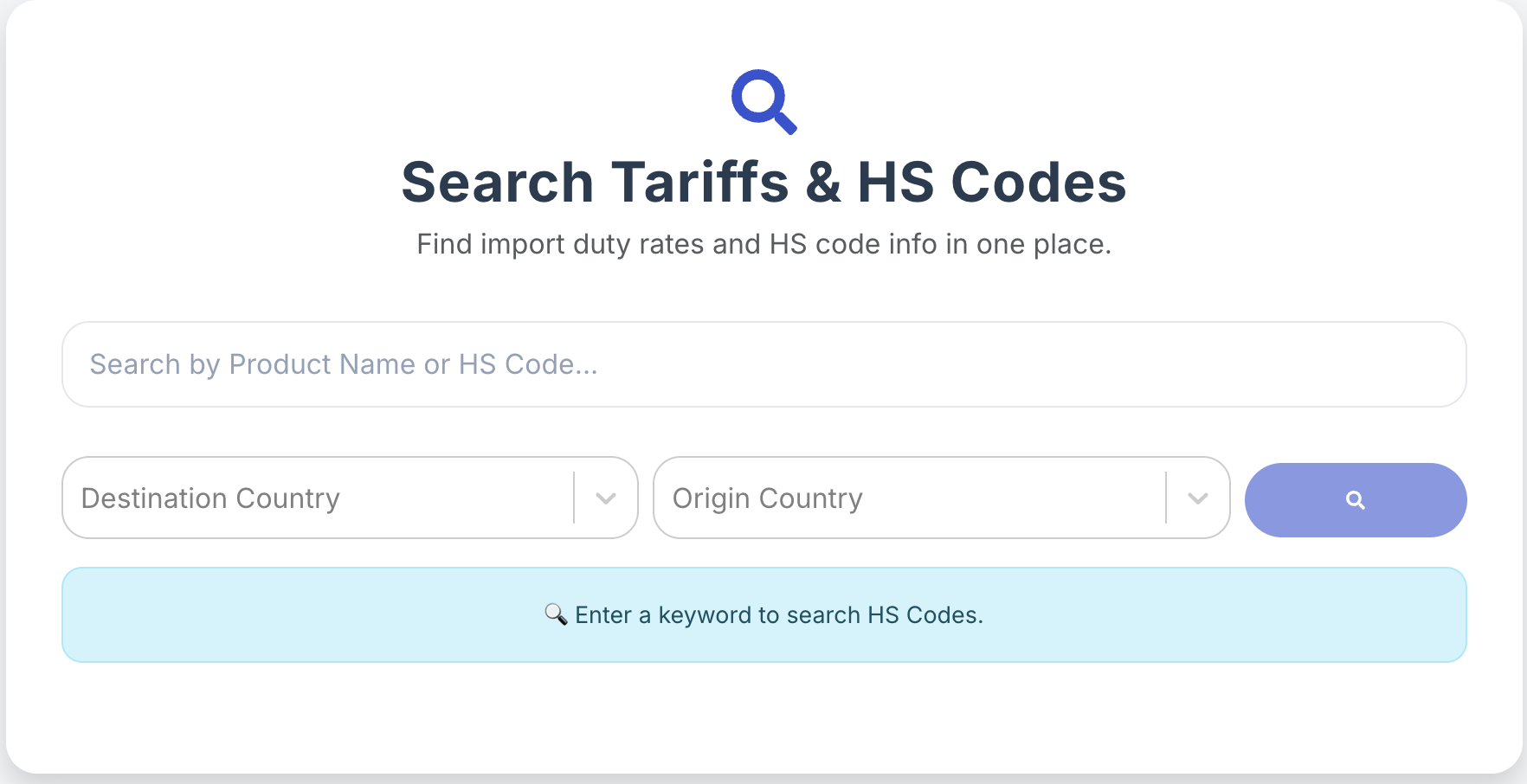

After knowing that tariffs are important in the international trade process. As an importer or exporter, you should know the tariff rate based on certain goods and the countries of origin and destination. This is required to know what the latest tariff or the regulation is for importing products from some countries and calculate the tariff to minimize the losses and profit.

Finding the latest tariff regulation of a specific country and goods is not an easy thing to do. We have to find directly on a certain government website or the World Trade Organization (WTO) data, which is difficult and time-consuming. Therefore, we are providing the Tariff Search to ensure that you can directly search based on your products, country of origin, and destinations.

Tariff Search provides several features to accommodate your needs in finding tariff rates on countries all over the world. Tariff Search gives you a convenient way to open the lists of tariff rates and the law and agreements between the country of origin and the destination country. Here are the advantages of using Tariff Search for your assistance.

Tariff Rate Search with HS Code Match Services

Tariff Search is a tool from Jureem to assist you in order to find the tariff rate based on your certain goods and specific countries. The Tariff Search tool will directly give you the lists of multiple possible tariffs on certain products. One of the advantages of using this tool is that the Tariff Search is combined with the HS Code Match Service. Therefore, you do not need another application other than Tariff Search to find the tariff and the HS codes based on the specific countries of origin and the destinations.

Once you search on the Tariff Search tool, the tariff and HS codes are displayed by choosing your country or origin and destination, and the products as well. You can directly lead to the possible rates to import products. For example, we can choose the meat from Australia to Thailand on the Tariff Search homepage.

The Tariff Search will provide all of the possible rates of importing meat from Australia to Thailand. Then, you can choose one of the tariff rates based on your preference. Afterwards, you can go directly to the detailed information of the HS code and tariff rates on the Tariff Search page.

In this page, you can find the import duty details and the FTA agreements, or the latest tariff rate between the two countries that you are looking for. Also, you can find the HS code description directly on the Tariff Search page, which makes it easier to get information about a certain HS code on a specific product in the export and importation process.

Tariff monitoring

The other advanced feature from Tariff Search is Tariff monitoring. This tool is useful for monitoring several tariff rates for your preferred goods, origin, and destination country. This tool would help you to find the best HS code and tariff rates in order to save your importation process.

You can also upload a bulk file of the lists of export and import products or HS codes in CSV or Excel format to this tool from Tariff Search. Then you can add and upload the products manually, or this tool will automatically add based on the top lists.

Tariff monitoring from Tariff Search allows you to upload directly the times to monitor the best HS code for the export and import process. This is an example of the best HS codes for exporting beef from India to Singapore is 02012000. Tariff monitoring from the Tariff Search shows that the lowest tax rate to export beef from India to Singapore is 0 percent.

AI Chatbot to ask questions about FTA provisions

One of the most advanced features that you can use in Tariff Search is the AI Chatbot. This feature from Tariff Search will give you a summary based on the documents of trade agreements between certain origin countries and the destination countries. Similar to other AI tools, you can directly chat with your document to find the specific part that you need to know. This will allow you to save time while attempting to find the FTA provision or rule of origin and other things.

Using this tool from Tariff Search is easy; you can just type the question that you want to ask in the Type your message bracket. Then press the send symbol on the right side of the page. The AI will answer all of your questions based on the documents of the FTA.