Custom Regulations Insight Chatbot

Doing some research before exporting and importing products is an essential thing to do for every party in international business. This step is crucial in order to alleviate the loss of profit due to the miscalculation of duties and lack of knowledge of the recent customs regulations in a specific country. We know that the process of finding out the customs regulations and tariffs of a specific country is arduous and needs detailed research.

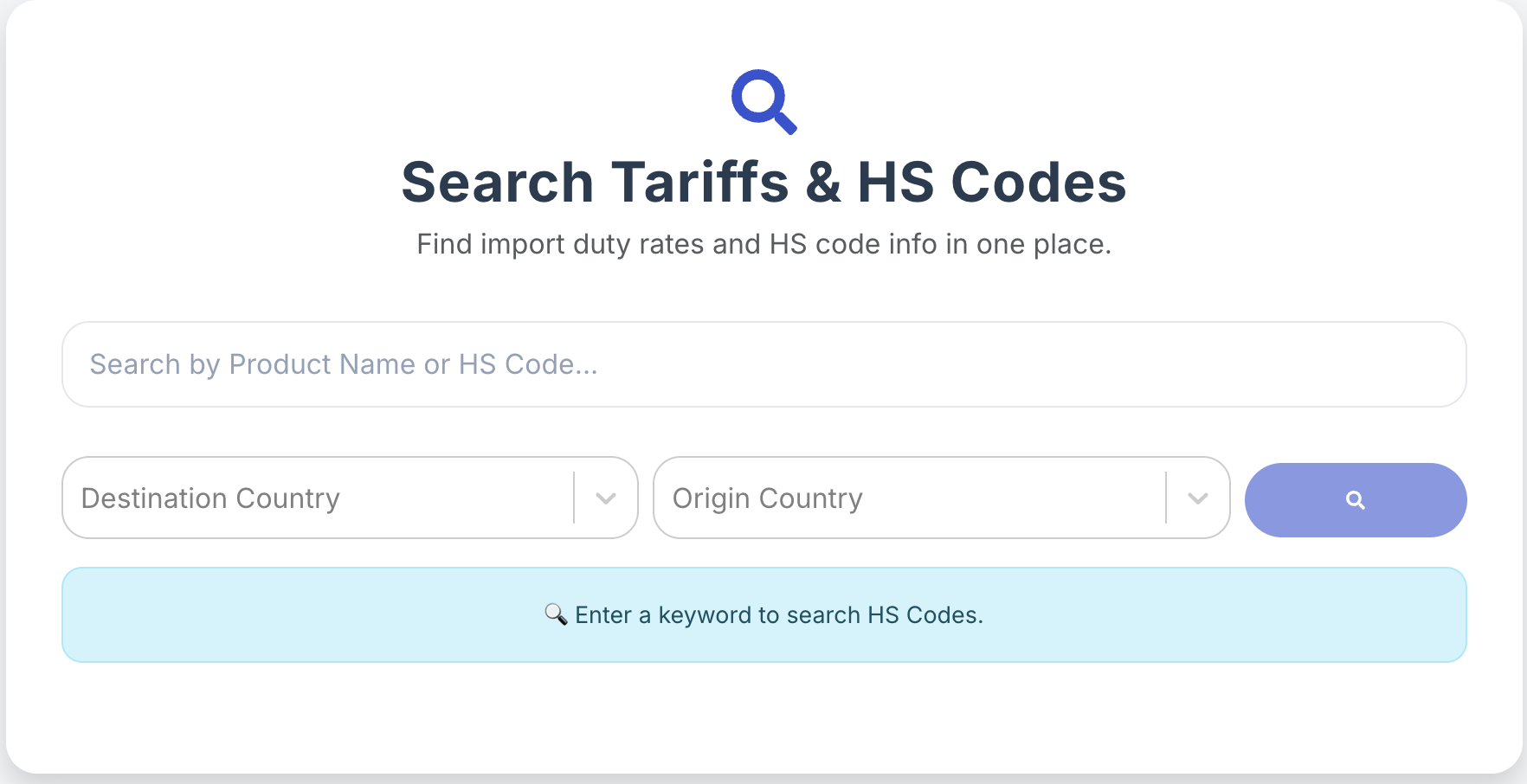

As a pioneer of the customs regulation assistant website and application, HS Code Match provides an advanced tool called Customs Regulation Insight Chatbot on each feature to make your work on the export and import process easier than before. Not only does it provide the customs regulations knowledge based on a trustworthy document, but it also gives you a chance to directly chat with the customs regulation documents.

By using this tool, you can get the answer easily from the specific part of the customs document that you are looking for. All of the things related to the customs regulations from countries worldwide are available in HS Code Match. Here is the breakdown of the Customs Regulation Insight Chatbot from Jureem HS Code Match.

Regulatory Compliance Insights

Regulatory compliance insights are one of the important concepts that all parties in international business should know. As we know, a regulation is a law developed by the government agencies in a certain country to prevent harmful goods from outside from harming the economy, market, and health of the citizens in that country. Therefore, every country has its own regulations that need to be adhered to. Then, the exporter and importer should follow these rules in order for their goods to enter the country without problems.

Understanding of the regulatory compliance insights is complex and time-consuming, as well as constantly changing due to the global competition and some geopolitical issues in some countries. Thus, we need a better comprehension of the regulations to circumvent the loss of profit due to the higher tariff or severe sanctions for the mistaken compliance with the procedure or law of the specific country. Here are the lists of regulatory compliance insights.

- Country-specific import/export requirements.

Regulations from every country are different from one country to another, and they are established by the government agencies of the countries. The difference in requirements of export and import depends on the interests of a specific country in the goods from other countries. Therefore, the conditions for similar goods from one country to another are different based on the regulations of the destination country. For example, the United States imposed a specific procedure or tariff on goods from China. This condition is based on the latest regulation from the United States regarding political tension, the results of negotiation, and the assessment of how far the existence of the imported goods affects the country.

- Sanitary & Phytosanitary (SPS) measures, Technical Barriers to Trade (TBT).

Sanitary & Phytosanitary (SPS) regulations are the policies of a specific country, as guidelines to shield the diseases, pests, or other harmful biohazards from other countries carried with the imported goods. These measures are implemented to prevent the detrimental diseases or pests from affecting the citizens, animals, or plants in a country. For instance, the United States is conducting an inspection for agricultural products from other countries before moving them into the country.

A similar form of the SPS measures that are implemented hand in hand is the Technical Barriers to Trade (TBT). Unlike the SPS, which focuses on health, TBT is a regulation that is specifically for the standardization of products before entering the country. The measures are developed to ensure consumer protection and how the product meets the labeling standard, as well as national security in their territory.

- Customs valuation rules and procedures.

Customs valuation rules are the law on how to determine the value of duties and taxes, such as value-added tax (VAT), etc., for imported goods. These methods of determining the customs valuation are based on the standard from the World Trade Organization (WTO). The customs officer will calculate the duties and taxes depending on the transaction value. After the decision on taxes and the payment from the exporter, customs will permit the goods to move in.

- Required licenses/permits (automatic & non-automatic).

Required licenses are permits for the goods to enter the country. These documents are critical in international trade in order to ensure that the goods comply with the requirements of a specific nation. These licenses can be differentiated into automatic and non-automatic standards based on the issuing country. The automatic permit is the condition that there is no restriction or quota on the imported goods. Meanwhile, the non-automatic permit is to be administered by the officer who ensures that the goods meet the detailed review.

Trade Agreement Integration

Trade Agreement Integration is the implementation of the free trade agreements (FTA), or other agreements, in order to reduce the tariffs and other burdens on international trade of various countries. This integration has a function to combine the agreement on the customs regulations, compliance standards, with the regulations, and the other export and import standards. The Trade Agreement Integration can be established by two or more countries within a bilateral, multilateral, or regional free trade agreement. These are the breakdown explanations of the application of Trade Agreement Integration.

- Identify applicable Free Trade Agreements.

Implementation of Trade Agreement Integration relies on the free trade agreement among the countries because all countries have the right to reduce tariffs on specific products or not. Before integrating the agreement, the government should see the applicable FTA for specific goods in its home country. This process will help to draw the integration of the FTA into its regulations.

- Show the rules of origin requirements

Showing the rules of origin (RoO) is the key process of the integration of FTA. This requirement will help integrate the customs regulations between two or more countries related to the origin of products. The products that are agreed upon by two or more countries can be lifted from the tariff, quota, or other barriers based on the FTA.

- Highlight tariff exemptions or reduced rates.

Tariff exemption and reduced rates on the FTA of two or more countries should be highlighted in the integration agreement. These implementations are established to make it easier to understand that products from a specific country within the FTA are subject to tariff exemption or reduced rates. However, this procedure needs to be based on mutual agreement.

Partner Government Agencies (PGAs)

Partner Government Agencies (PGAs) are known as one of the important parties from the government to help customs officers draw the lines and laws of specific goods from other countries. Not only creating the regulations, but they are also conducting direct inspections along with the customs officer at the port, airport, or the national border to enforce the international trade law.

PGAs can be from various government institutions in a country that are specifically assigned to prevent the harmful goods from other countries. These institutions also have the role to certify and issue a permit for goods to enter the country based on the results of the assessment. PGAs have the right to prohibit specific products from entering the national territory if the goods do not meet the standard.

- Info on additional regulatory bodies (e.g., food safety, environmental, health).

The regulatory bodies of PGAs are assigned to prevent harmful products from entering the national border. These government bodies are operating in many sectors, including food safety, environmental protection, disease prevention, health preservation, and others. The information of PGAs is essential for parties who engage in international trade because these agencies establish the guidelines in order to move the product into the country. All of the exporters and importers should follow the guidelines and regulations from these agencies.

- Required documents and certifications (health certificates, phytosanitary, CE mark).

PGAs release the compulsory documents and certification for specific goods to enter the national territory. Therefore, all of the parties should adhere to and understand the prerequisites from these agencies to make their goods flow smoothly into their country. These certifications can be found in many forms, such as health certificates, phytosanitary permits, CE mark, toxic substance certification, emission and safety certification, etc.

Document Guidance

Document guidance is an essential tool to complete the prerequisite documents. This guidance should be based on the regulations of destination countries and specific goods. This guidance will assist you in collecting the documents that are essential in order to ensure that your goods will easily pass through customs and the PGAs process smoothly. This is the breakdown of the implementation of guidance for completing the international trade requirement documents

- Checklist of documents needed for customs clearance.

One of the essential procedures that you should include as guidance is a checklist. However, you need to research the requirement document first in order to create the checklist, which is important due to the different requirements based on goods and destination country regulations. The checklist will assist you in avoiding the missing one or two documents for the export and import process. Once you have fulfilled the documents, you can directly process the next steps. The checklist can be used to quickly process the document for customs clearance.

- Step-by-step process flows for import/export.

The steps of importing products from another country can be classified into eight processes as follows,

- Contact or purchase between two parties: means that the buyer has reached a deal with the supplier from another country. The two parties are creating a contract, including payment, shipping process, and other terms of agreement.

- Preparation of goods to be imported: The goods from the supplier are prepared and assembled in the factory. The supplier has the responsibility to obtain the permit or other certification so that their products can be transferred into other countries.

- Fullfillment of the shipping documents: The supplier also needs to prepare all of the required documents for exporting before the shipping process. This document, including Invoice, Packing List, Bill of Lading/Airway Bill, Certificate of Origin (CoO), and the PGA certificates, is a requirement from agencies in the destination countries. Then, the goods can be sent to the destination country.

- Claimed the customs declaration: After the products arrive in the destination country. The importer or customs broker has a mandatory obligation to file the declaration of importation with the customs agency. The importer needs to deliver all of the documents.

- PGA clearance: The customs hand over the goods to the authorized PGAs to be inspected. The PGAs will conduct an inspection to assess whether the products meet the regulations in this country.

- Assessment from the customs officers: After the PGA gives clearance for the products. It will be sent back to the customs authority. The customs will calculate the duties, taxes, and other fees based on the origin of the products. The importer will pay all of the duties and taxes as a requirement for the products to be released.

- Release of the products: The products are released and can be transferred into the warehouse. However, the importer should check the product before leaving the international port or airport.

- Post-clearance of the imported goods compliance: The importer can claim if there are any issues related to the miscalculation of the duties or taxes, and other disputes related to the clearance.

- Templates or reference to standard customs forms.

The customs authority in a country provides the template or the documents that need to be submitted by the importers. This template can be accessed on the custom authorities website in every country. The template has a function to standardize the procedure and documents for importing goods from other countries. There are also additional document requirements based on the country of origin, such as documents from PGAs in the destination country.

Monitoring & Alerts

Monitoring and alerts are one of the important steps before exporting or importing a product. Due to the frequent changes, the monitoring process must be done in order to alleviate severe tariffs. Therefore, the parties in international trade must be aware of the changes and the newest regulations from the destination country. If they miss one of the regulations or the latest requirements documents, there is a risk that the products will be rejected or must undergo special treatment before being released. The monitoring process can be found in the Jureem HS Code Match, along with the Custom Regulation Insight Chatbot.

- Real-time alerts on regulatory or tariff changes.

Real-time alerts on regulation or tariff changes can be identified in the Customs Regulation Insight Chatbot. This AI Chatbot is developed to identify the part of the latest document that needs to be informed accurately and in real time. This will help you to decide the final action before exporting or importing goods.

- Notifications for restricted/prohibited goods updates.

Not only providing real-time alerts, but the Customs Regulation Insight Chatbot can also be used for giving notifications of the restricted or prohibited products. This notification will lead you to determine the stop of the importation if the specific goods are not allowed in the destination country. This will reduce the loss of the shipping process and other expenses due to missing the regulatory updates.

AI Assistant to look for lower tariff rates for goods import

Looking for tariff rates can be quite exhausting because we need to consider many components of the imported goods when determining their destination country. We need to review the regulations and other requirements for specific goods. For that reason, Jureem HS Code Match gives solutions to make your journey of researching tariff rates effortless. As a pioneer of customs and tariff rates, HS Code Match provides an AI Assistant to help you find the best tariff rates for your products.

Check the Free Trade Agreements (FTAs)

HS Code Match allows you to check if your country of origin and the destination country have free trade agreements (FTA). This agreement is important to know whether the goods are included in the tariff reduction or other compromise that lifted burdens on bilateral or multilateral FTA.

- Many countries have bilateral or multilateral FTAs that reduce or eliminate tariffs.

FTA is accepted by many countries all over the world. These agreements are a way to eliminate tariffs and other barriers in order to grow the trade relations between two or more countries. Therefore, this is the opportunity to maximize the export of our potential products to the destination countries. For example: ASEAN–China FTA, EU–Vietnam FTA, USMCA (NAFTA replacement).

- These are the steps of finding FTA on HS Code Match:

- Search if your exporting country has an FTA with the importing country.

- Search if your exporting country has an FTA with the importing country.

- Verify if your product meets the rules of origin to qualify.

- If yes → you may reduce tariff from, say, 30% MFN → 0% under FTA.

- Use an AI Chatbot to find the FTA regulation

Explore Tariffs & Quotas

Tariff rates and quotas are the policies of a country to protect its domestic market from potentially damaging products from other countries. However, the compromise negotiation and FTA can result in tariff exemptions and quotas between the two countries. These are the breakdown of the tariff exemptions and quotas that are implemented in a country.

- Some goods qualify for:

- Tariff rate quotas (TRQ): The trade policy implemented by the government of a specific country to lower duties on limited volumes of imported products from a certain country.

- Duty suspensions: This policy has a function to temporarily reduce/eliminate duties for certain imported products, especially raw materials. Duty suspensions can be used to promote the production of certain industries in the country.

- Exemptions: This policy applies to exempt the quota and tariff of the importation of humanitarian goods, R&D samples, and re-imported goods.

- Explore tariff exemptions and quotas to maximize your export and minimize the loss due to tariffs using HS Code Match through these steps:

- Check government customs notices.

- Apply before shipment if quota-based.

Optimize Country of Origin/Shipping Route

The Country of Origin (CoO) should be optimized in order to minimize the impact of the tariff in the destination country. Thus, the industry should define that the products originate from the country that has the lower tariff implemented by the government in the destination country. The shipping route is one of the main factors in maximizing international trade by reducing the cost of shipping and minimizing the loss due to the shipping process. The companies are trying to relocate their industry to strategic countries to approach the market.

- Duty rates often vary based on the origin country.

As we know, duty rates between one country and another are different. The decision on duty rates is based on the political and economic interests of the two countries. Thus, the industry tries to look at the opportunities from the country that has a good relationship with the destination country to minimize the impact of the duties.

- If your supply chain allows, sourcing from an FTA partner country may cut costs.

In this globalization era, the supply chain of source products varies in order to maximize production and minimize cost. Some companies are relocating production or assembly to the member countries of the FTA. This decision aims to minimize the impact of the tariff and get various advantages from being a member of the FTA. For example, automotive companies are relocating production to Mexico to minimize production costs, proximity, and the lower tariffs to export to the United States.

- Here is the example of importing textiles into Spain and Sweden within the European Union: → higher duty from China, lower duty from Bangladesh under GSP+.