What are customs regulations?

Customs regulations are the regulations to protect the flow of goods and services from other countries into a certain country’s national borders. These regulations are implemented by the customs institution of a country to ensure that products from other countries are not harmful and comply with all the laws in that country. Therefore, customs regulations are different from country to country and are based on each country’s policy.

The customs regulations are developed by the country’s policymakers through executive and legislative bodies. These regulations should adhere to the common principle of international trade law set by the World Trade Organization (WTO) and the trade agreements between two or multiple countries, such as free trade agreements (FTA). For example, a country’s customs regulation should follow the agreement in the trade regional block that established a customs union, including the European Union Customs Union (EUCU), Eurasian Customs Union, Southern African Customs Union (SACU), etc. These laws should be aligned with the local policy related to certain goods and services that move into their country.

The main purpose of customs regulations is to prevent goods and services from being illegally moved in the country. This would ensure that all of the goods and services are legal to be marketed and pay the duties and taxes accordingly based on the trade agreement between two or multiple countries. Thus, the customs officer should have a better understanding of the customs regulations based on the country of origin of certain goods and services.

If there are no customs regulations, the market situation of a country would be catastrophic, and the illegal product would flood into the country and wreck the market. The cheap products from other countries easily dominated the market and made the locally produced products uncompetitive in the local market. On the other hand, the harmful products, such as narcotics, weapons, hazardous material goods, and other smuggled goods, would easily enter the country without being checked.

We should understand how important customs regulations are in each country. Not only customs officers, but also importers, exporters, or distributors should adhere to the customs regulations in order to ensure that their product is legal and meets the law and standards to enter or leave the country. This would alleviate the products being seized by customs officers while entering the country. Here are the components of customs regulations.

Import Licensing Requirement

Import licensing requirements are the certification process that has to be obtained in order to import goods and services from other countries can enter a country. These licenses can be acquired from the government institution that regulates the import and export. These licenses are required to confirm that the products are not harmful to the environmental, health, and economic interests of each country.

The license requirements are adopted based on the categories of products, such as agricultural products, advanced technological products, chemical products, and others. Therefore, imported products should have permission based on the trade policy of a country, depending on the classification of products. These are the lists of import licensing requirements as an initial procedure for importing goods from other countries.

Automatic Licensing

Automatic licensing is one of the types of importing licenses that does not require specific restrictions for the applicants. This licensing is intended to monitor the import process without the need to do any controls. Thus, once all of the requirements from the applicants are met, the license is automatically granted.

The automatic licensing has the intention of collecting statistical data from certain imported products in a country. This data will inform the trend of trade from imported goods in the country in order to make a decisive strategic trade policy.

Non-Automatic Licensing

In contrast to automatic licensing, non-automatic licensing is a type of importing license that requires more details than automatic licensing. This type of certification process is intended to restrict certain goods and services from entering the country. Therefore, the applicants should not only meet the requirements, but also meet the additional requirements from the country’s authority to import products.

This limitation has the purpose of implementing a quota on specific products to move into a country to ensure healthy competition in the market. Non-automatic licensing can also be used for national security and to protect the environment, public health, and the safety of all the citizens in a country. This licensing is applicable to prevent fraudulent activities or the risk of flowing the harmful goods into the country.

Controlled Goods

Controlled goods licensing is a type of license from the government of a country to control the imported products that have a potentially significant impact on security. This licensing needs to be obtained for exporting or importing the products that have dual-use functions as commercial products and military use products. For example, Canada has Controlled Goods Programs to check and examine the dual-use products prior to giving permission for goods to be entered into Canadian territory.

Export Controls

Not only import restrictions, but there is an export control regulation from a country as a prior standard of international trade. These policies are developed to ensure that dangerous materials and products, as well as products that could harm the economic interests of other countries, are not easily exported out of the country. These laws have the intention of meeting the standards of international trade.

These controls are mainly for dangerous products, including dual-use items that can be used as commercial and military products, sensitive goods or technology products, strategic goods, and smuggled goods to the sanctioned countries. These goods can be used for military interests by terrorist organizations. These regulations are very important in order to ensure the safety and not the risk of potential terrorist action in other countries.

Export Licensing

Similar to import licensing, export licensing is a certification process to export certain products in order to meet the legal standards of a country. These documents are needed by companies or individual to export their products to other countries. These licenses are issued by the government bodies of a specific country. According to the International Trade Administration from the United States government, most of the exported goods do not require an export license.

Prohibitions & Bans

Export prohibition and bans are measures implemented by the government of a country to prohibit certain goods from entering its territory. These regulations are more restrictive than the export licensing because export licensing still allows some of the products to enter. Meanwhile, prohibition regulations are intended to block the flow of goods from entering the country. For example, European Union member countries are prohibited from exporting sensitive products to Russia due to the invasion of Ukraine.

Quotas & Restrictions

Quotas and restrictions are used by the government of a country to limit the export of certain products to a specific country. This regulation is imposed by a government in order to protect the domestic market and prioritize the needs of its country to prevent the scarcity of certain goods. This measure has implications for stabilizing the domestic price of certain products and preventing price inflation in the country due to a price spike.

Dual-Use Controls

Dual-use controls are the regulations that restrict the export of products that are considered to be dual-use to other countries. These products can be goods, chemicals, software, etc, that can be used for two purposes: commercial and military usage. These types of goods are strictly monitored by the government of a country due to the possibility of harmful effects on other countries. For example, the European Union restricts the export of chemical products to certain countries that have the possibility to develop weapons of mass destruction.

Customs Penalties

Custom penalties are the range of punishments for companies or individuals who breach the customs regulations of specific countries. These penalties include financial or legal sanctions for companies or individuals based on the degree of the violation. These penalties are established to ensure that all of the parties in international trade comply with the laws and regulations of a country.

Customs penalties can be classified into three, including administrative penalties and criminal penalties. The administrative penalties are considered to be milder than the criminal penalties, so the violators do not have to be persecuted or threatened with jail. The administrative penalties include fines, seizure, rejection, or suspension of the product from entering the country.

What kind of documents are required for customs clearance?

Before exporting or importing products from or to other countries, you need to gather the documents that are needed for customs clearance. Compliance with all the customs regulations documents would make your process for customs clearance easy and smooth. Therefore, you need to ensure all of the customs regulations documents are fulfilled. Here are several prerequisite documents for customs clearance.

Commercial Invoice

A commercial invoice is the document that needs to be checked by the customs authorities of a country. This document is going to be assessed based on the clarity of the transaction. The customs will verify that the names of the seller and buyer are the parties that are included on those documents. The customs will calculate the quantity of products from this document to impose the duties. Therefore, the detailed transaction, including date, name, and quantity of products, and other transaction agreements, should be included in the commercial invoice. If one of the parts of this document is incorrect, it would be an indication of potential fraud and smuggling of illegal products.

Transport Documents

A transport document, also called a Bill of Lading (BoL), is a document that is required for shipping products from one country to another. This document is provided by the freight forwarder and contains the specific details of the products and where the products are coming from and being sent. BoL also contains the name of the shipper, freight forwarder, and the consignee, or the party who picks up the products. If the shipping process uses air transport, the transport document is called an Air Waybill.

Packing List

A packing list is one of the crucial documents for exporting products from a country. This document contains information on how the products are being packed, as well as information on dimensions and weight. This document is required to include marks and identification. The packing list would make the shipping and customs clearance process run smoothly.

Certificate of Origin (CO)

A Certificate of Origin (CO) is a document that is needed to export products to another country. This document is a document to confirm that this product is from a specific country. CO provides the information about the products, where they are made, and where they are destined. For example, a product contains the marks “Made in Germany” which indicate that this product is from Germany. CO is important because it is an initial indication of whether these products are subject to duties or qualified to be exported.

Import declaration

An import declaration is a formal document to be handed to the customs bodies in a country. This document is required in the shipping process by companies or individuals who want to import products to a country. An import declaration has the function to declare that the imported goods comply with all the requirements to enter the country. This document is a complement to the several required documents to import a product to the country mentioned above. However, many countries have implemented the simplification procedure, and you can fill out the import declaration and submit the document online.

Customs Regulations Search

From the explanation above, we understand that customs regulations require many prerequisites and documents. As an importer, distributor, and exporter, you need to know the latest customs regulations of a specific country in order to comply with each country’s customs law. If not, your products will be suspended because of the mistake, or even your products will be suspended, and in the worst case, your products will be seized or rejected.

Finding the customs regulations based on certain goods of each country is also not an easy thing to do. We need to find the customs regulations on the official websites of the country that we are looking for. This method is time-consuming and hard because we have to look at the customs documents one by one.

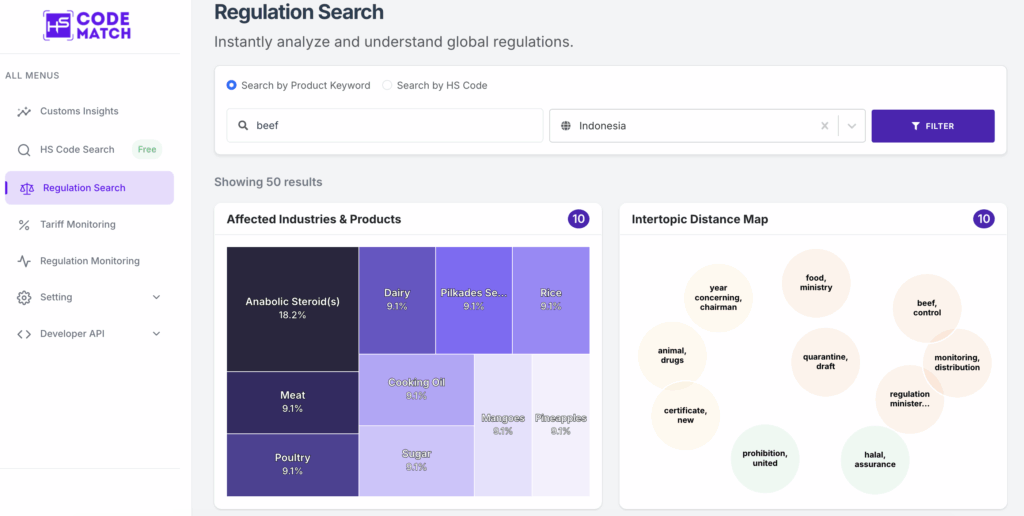

One thing that makes finding custom regulations easy is using the Regulation Search from Jureem HS Code Match. This tool will assist you in getting accurate and reliable information from official government documents regarding the latest customs laws that apply to specific products that you are looking for. Here are the advantages of using Custom Regulation Search from HS Code Match.

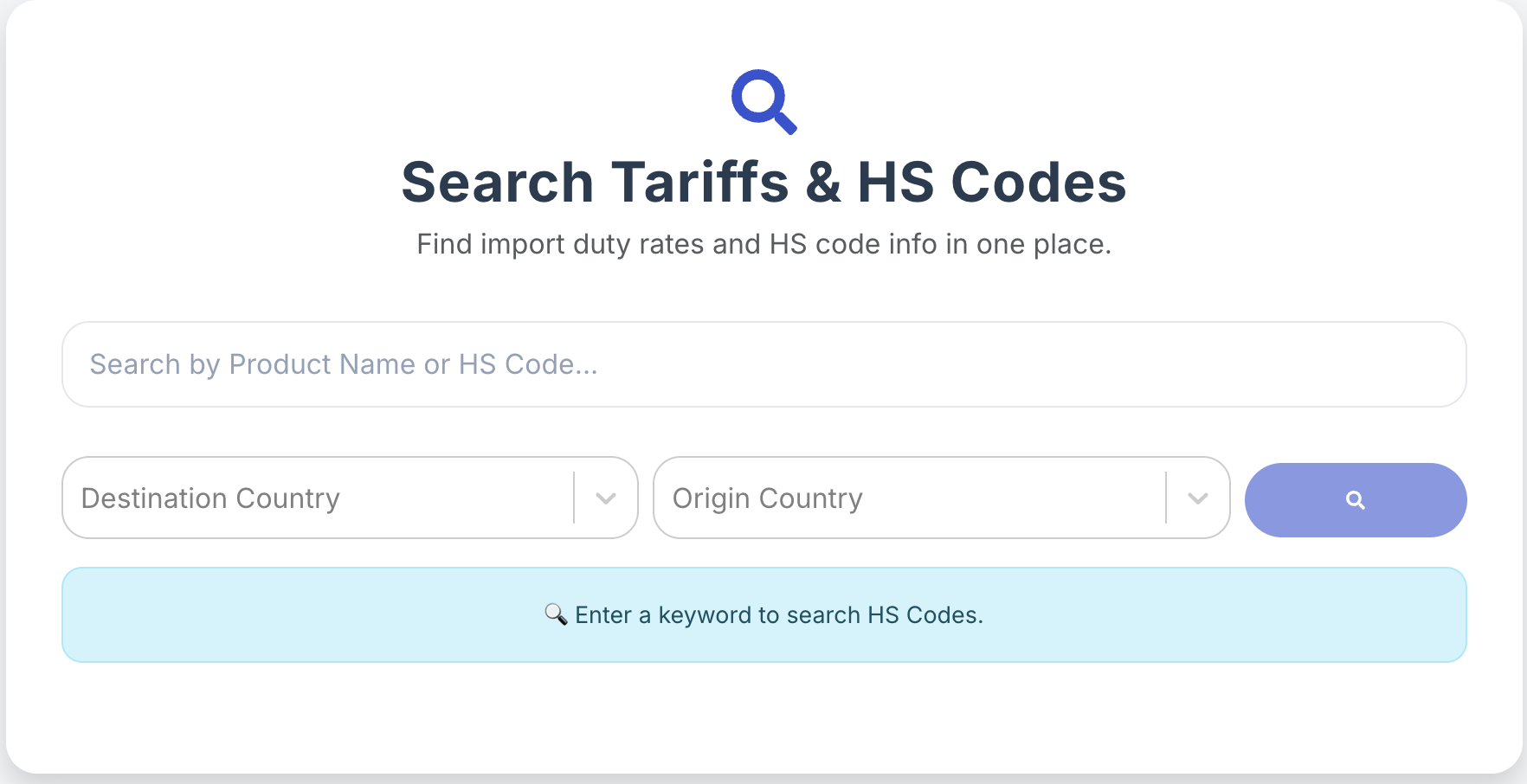

Using a simple product keyword or HS Code search to find relevant regulations

Regulations Search is easy to use, and it has a minimalistic user interface. You can just open this tool by typing https://app.hscodematch.com/regulation-search in your browser. Then, choose the products and the country that you are looking for. Click the search button to look at the result of the custom regulations. You can find the latest regulations list, and you can choose to look at the documents.

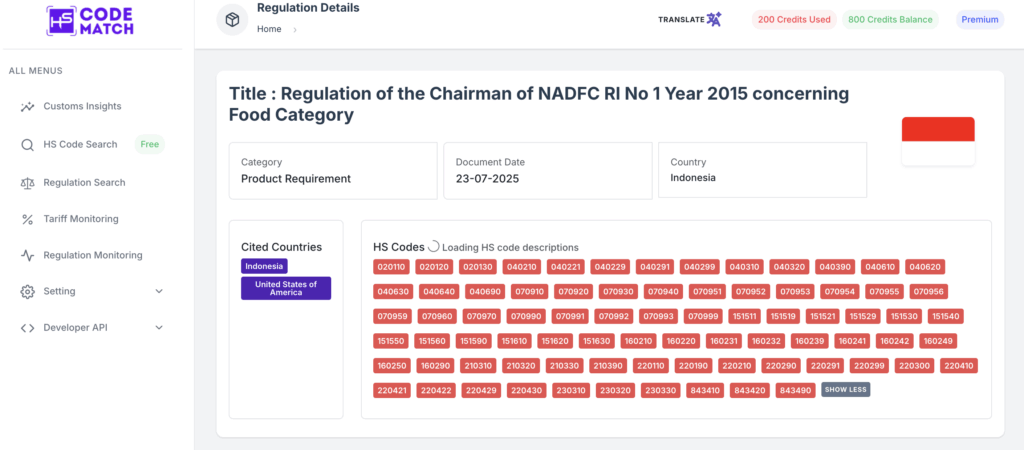

After choosing one of the results, you can see the detailed information on the customs regulations. For example, this is the new regulation from Indonesia related to the importation of beef from Brazil. You can see the regulation summary and the source documents to ensure that this is from credible information. Regulations Search also provides AI Assistance, which allows you to chat with the documents, and you can ask anything.

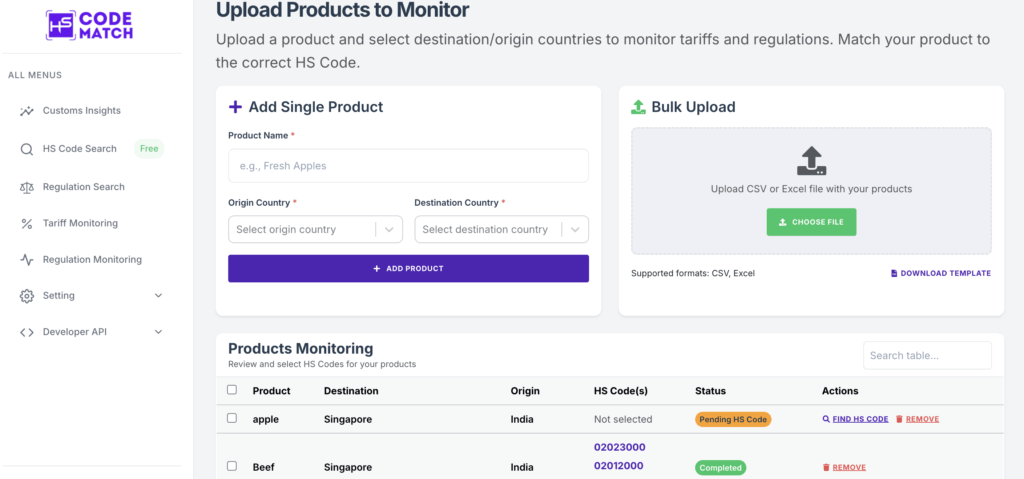

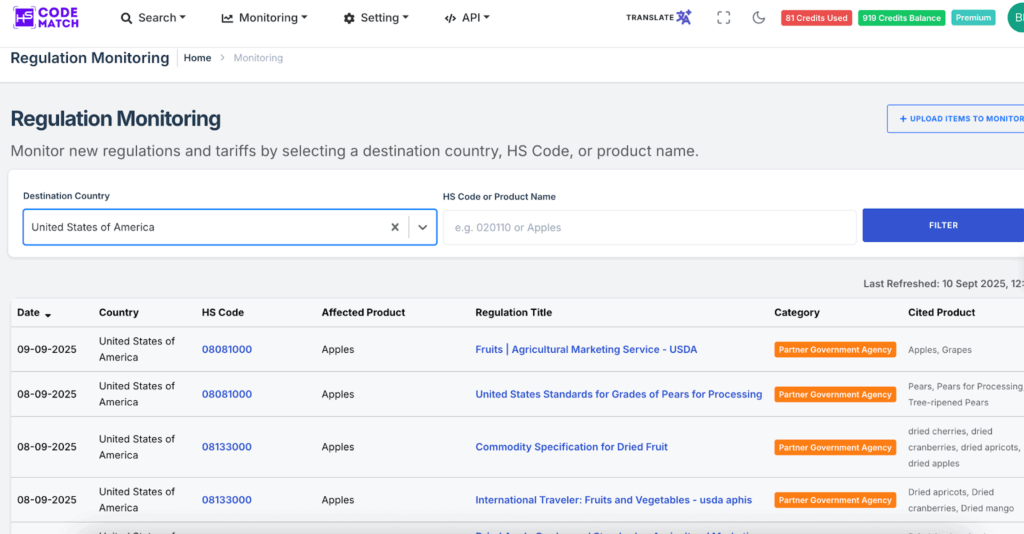

Regulations Monitoring by uploading a Product List

Not only providing a search engine, HS Code Match also provides the Regulations Monitoring tool. This tool allows you to monitor the regulations and tariffs on specific products by selecting the country, the HS code, and the name of the product. You can just type https://app.hscodematch.com/regulation/monitoring in your browser to access this tool. Then, select the country and products that you want and click the filter button on the right side of the page. This will automatically filter the regulations that you are looking for. For example, we can choose the United States in the country bracket and apple in the product bracket.

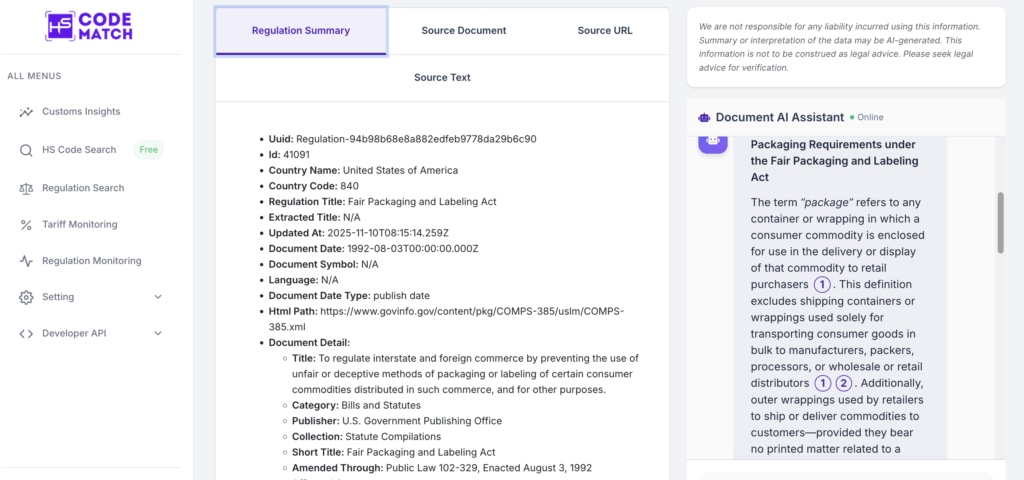

Similar to other HS Code Match tools, you can access one of the latest regulations and look at the detailed information related to the products from the United States. Again, you can chat with the documents by using the AI Assistant. This feature will help you understand the specific information related to the part of the document without needing to read all of it.

The interesting feature from Regulations Search Monitor is that you can upload a bulk of documents in CSV and Excel format in order to monitor certain products from a specific country. Then, you can add the product, origin country, and destination country as well in the Add Single Product bracket. This allows you to monitor the latest regulations from the country that you are looking for.